ACC 499 ACC499 ACC/499 ENTIRE COURSE HELP – ASHFORD UNIVERSITY

$149.99$275.00

ACC 499 ACC499 ACC/499 ENTIRE COURSE HELP – ASHFORD UNIVERSITY

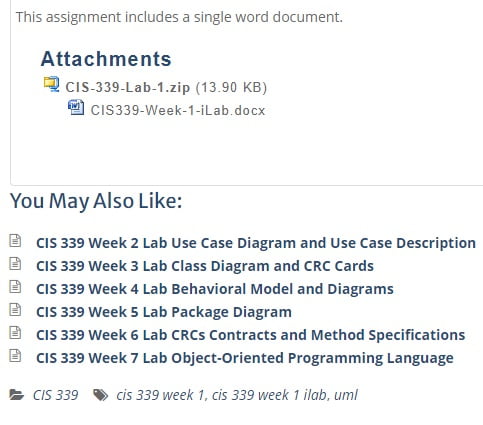

ACC 499 Final Exam Part 1 (2 Sets)

ACC 499 Final Exam Part 2 (4 Sets)

ACC 499 Midterm Exam Part 1 (4 Sets)

ACC 499 Midterm Exam Part 2 (3 Sets)

ACC 499 Week 10 Assignment 3 Capstone Research Project (2 Papers)

ACC 499 Week 1 DQ 1 Operating and Capital Leases and DQ 2 Leasing Restatements

ACC 499 Week 10 DQ 1 Taxes and DQ 2 Bethlehem Steel Corporation’s

ACC 499 Week 11 DQ 1 Course Wrap-up and DQ 2 Application

ACC 499 Week 2 DQ 1 Equity-Based Compensation and DQ 2 Harley-Davidson(B) 2010

ACC 499 Week 3 Assignment 1 Amazon.com Business Combinations and Financial Results Analysis (2 Papers)

ACC 499 Week 3 DQ 1 Global Mergers and Acquisitions and DQ 2 Sirius XM Radio

ACC 499 Week 4 DQ 1 Fair Value Accounting Under IFRS and DQ 2 Asset Impairments

ACC 499 Week 5 DQ 1 Accounting for Pension Plans and DQ 2 General Motors

ACC 499 Week 6 DQ 1 Cyberattacks in Public Companies and DQ 2 Koss Corporation

ACC 499 WEEK 7 ASSIGNMENT 2 LITIGATION, CENSURES, AND FINES (2 Papers)

ACC 499 Week 7 DQ 1 Channel Stuffing and DQ 2 Carton Medical Devices

ACC 499 Week 8 DQ 1 AICPA Code of Professional Conduct Violations

ACC 499 Week 9 DQ 1 Internal Controls and DQ 2 Apple, Inc

Description

ACC 499 ACC499 ACC/499 ENTIRE COURSE HELP – ASHFORD UNIVERSITY

ACC 499 Final Exam Part 1 (2 Sets)

ACC 499 Final Exam Part 2 (4 Sets)

ACC 499 Midterm Exam Part 1 (4 Sets)

ACC 499 Midterm Exam Part 2 (3 Sets)

ACC 499 Week 10 Assignment 3 Capstone Research Project (2 Papers)

ACC 499 Week 1 DQ 1 Operating and Capital Leases and DQ 2 Leasing Restatements

ACC 499 Week 10 DQ 1 Taxes and DQ 2 Bethlehem Steel Corporation’s

ACC 499 Week 11 DQ 1 Course Wrap-up and DQ 2 Application

ACC 499 Week 2 DQ 1 Equity-Based Compensation and DQ 2 Harley-Davidson(B) 2010

ACC 499 Week 3 Assignment 1 Amazon.com Business Combinations and Financial Results Analysis (2 Papers)

ACC 499 Week 3 DQ 1 Global Mergers and Acquisitions and DQ 2 Sirius XM Radio

ACC 499 Week 4 DQ 1 Fair Value Accounting Under IFRS and DQ 2 Asset Impairments

ACC 499 Week 5 DQ 1 Accounting for Pension Plans and DQ 2 General Motors

ACC 499 Week 6 DQ 1 Cyberattacks in Public Companies and DQ 2 Koss Corporation

ACC 499 WEEK 7 ASSIGNMENT 2 LITIGATION, CENSURES, AND FINES (2 Papers)

ACC 499 Week 7 DQ 1 Channel Stuffing and DQ 2 Carton Medical Devices

ACC 499 Week 8 DQ 1 AICPA Code of Professional Conduct Violations

ACC 499 Week 9 DQ 1 Internal Controls and DQ 2 Apple, Inc

ACC 499 ACC499 ACC/499 ENTIRE COURSE HELP – ASHFORD UNIVERSITY

ACC 499 Final Exam Part 1 (2 Sets)

This Tutorial contains 2 Sets of Final (All Question Listed Below)

ACC 499 Final Exam Part 1 (Set 1)

ACC 499 – Final Exam Part 1 (Chapters 5-7)

Question 1

Vested benefits are

Question 2

According to current GAAP, termination benefits paid to an employee should be

Question 3

The projected benefit obligation is equal to the

Question 4

Which of the following is not a component of the net periodic pension expense to be reported on a company’s income statement?

Question 5

Unrecognized prior service cost would be reported on the balance sheet and affect the amount(s) reported for

Question 6

If an employer were to account for a defined benefit pension plan on the cash basis, it would be a violation of the

Question 7

GAAP for pension plans requires companies with defined benefit pension plans to

Question 8

A company’s net periodic pension cost (expense) includes all of the following items except

Question 9

The expense for other postretirement benefits, such as health care benefits, dental benefits, and eye care benefits, currently is accounted for

Question 10

Spoofing is which of the following?

Question 11

A risk assessment should:

Question 12

The best way to reduce fraud in an e-business environment is to focus on _______?

Question 13

Viewing information that passes along a network communication channel is referred to as:

Question 14

___________ are self-contained programs that spread via direct transfer, email, or another mechanism.

Question 15

What is the primary electronic transaction and document control used in e-commerce?

Question 16

Separation of duties falls under which of the following internal control element

Question 17

Generally, the best way to prevent fraud in e-business settings is to focus on:

Question 18

Phillips Corp. purchased raw materials with a catalog price of $60,000. Credit terms of 3/15, n/60 apply. If Phillips uses the net price method, the purchase should be recorded at

Question 19

The purchases discounts taken account may appear in the accounting records if which one of the following methods is used to account for purchase discounts?

Question 20

The cost of goods sold can be determined only after a physical count of inventory on hand under the

Question 21

An American company purchasing goods from a foreign supplier has to account for differences in currencies. This process is made easier

Question 22

Which of the following items would not be used in the calculation of the cost-to-retail ratio if the FIFO retail inventory method were used to determine the ending inventory?

Question 23

When comparing the lower of cost to market

Question 24

The most common approach to implementing the lower of cost or market rule for inventory valuation is to apply it

Question 25

Relevance of the gross profit margin depends upon

ACC 499 Final Exam Part 1 (Set 2)

Final Part 1 ACC 499 Capstone

Question 1

Current GAAP requires that the net gain or loss from a settlement or curtailment be included in the

Question 2

Because of significant government funding of benefits to retirees, it is likely that total pension costs are

Question 3

Vested benefits are

Question 4

The interest rate that may be used to compute the interest cost component of pension expense is equal to the

Question 5

Current GAAP defines the required calculations for all of the following items except

Question 6

GAAP for pension plans requires companies with defined benefit pension plans to

Question 7

The expense for other postretirement benefits, such as health care benefits, dental benefits, and eye care benefits, currently is accounted for

Question 8

A company’s net periodic pension cost (expense) includes all of the following items except

Question 9

A pension plan provides for future retirement income based on the employee’s income and length of service with the company. This type of pension plan is termed a

Question 10

Viewing information that passes along a network communication channel is referred to as:

Question 11

Which is the most secure method of computer authorization?

Question 12

In an electronic environment, no other control can better prevent fraud than the wise use of:

Question 13

Which of the following uses features of the human body to create secure access controls?

Question 14

Spoofing is which of the following?

Question 15

Traditional ___ reduces the risk of falsified identity.

Question 16

Locks on the doors to the computer room, is an example of which electronic control?

Question 17

Specific fraud risks to conducting e-business include:

Question 18

Phillips Corp. purchased raw materials with a catalog price of $60,000. Credit terms of 3/15, n/60 apply. If Phillips uses the net price method, the purchase should be recorded at

Question 19

An American company purchasing goods from a foreign supplier has to account for differences in currencies. This process is made easier

Question 20

A retail firm would normally use an inventory account titled

Question 21

IFRS do not allow the use of LIFO because it

Question 22

When comparing the lower of cost to market

Question 23

Which of the following items would not be used in the calculation of the cost-to-retail ratio if the FIFO retail inventory method were used to determine the ending inventory?

Question 24

The most common approach to implementing the lower of cost or market rule for inventory valuation is to apply it

Question 25

When applying lower of cost or market, market value

ACC 499 ACC499 ACC/499 ENTIRE COURSE HELP – ASHFORD UNIVERSITY

ACC 499 Final Exam Part 2 (4 Sets)

This Tutorial contains 4 Sets (All Question Listed Below)

ACC 499 Final Exam Part 2 (Set 1)

Question 1

A member of the AICPA must safeguard the confidentiality of client information. Auditors, however, must disclose information to non-clients for the following reasons except to:

Question 2

Independence is not required for which of the following types of services?

Question 3

In which of the following situations would a CPA not be considered independent?

Question 4

Mark Pulley is an auditor at Pulley and Hurst, LLC. If Pulley’s five-year-old daughter owns shares of stock in McBurgers Corporation, then Pulley is considered to have what type of interest in McBurgers Corporation?

Question 5

Which one of the following is an example of a conflict of interest for a CPA?

Question 6

William Tyler, CPA, may not accept a commission for recommending a product or service to which type of client?

Question 7

The ethical framework derived from utilitarianism and rights theories indicates all of the following steps except

Question 8

Normally the auditor is not permitted to divulge confidential information obtained from a client. Which of the following situations would be a violation of this requirement?

Question 9

Which of the following indicates a strong internal control environment?

Question 10

When duties cannot be segregated, the most important internal control procedure is

Question 11

The fundamental difference between internal and external auditing is that

Question 12

The importance to the accounting profession of the Sarbanes-Oxely Act is that

Question 13

Control activities under SAS 109/COSO include

Question 14

Control risk is

Question 15

The most cost-effective type of internal control is

Question 16

Which of the following suggests a weakness in the internal control environment?

Question 17

Tests of controls include

Question 18

Which of the following taxes are included in the total income tax expense of a corporation reported on its Federal tax return?

Question 19

Which of the following items are not included in the financial statement income tax note effective tax rate reconciliation?

Question 20

Paint, Inc., a domestic corporation, owns 100% of Blue, Ltd., a foreign corporation and Yellow, Inc., a domestic corporation. Paint also owns 40% of Green, Inc., a domestic corporation. Paint receives no distributions from any of these corporations. Which of these entities’ net income are included in Paint’s income statement for current year financial reporting purposes?

Question 21

Hot, Inc.’s primary competitor is Cold, Inc. When comparing relative deferred tax asset and liability accounts with Cold, which of the following should Hot do?

Question 22

Music, Inc., a domestic corporation, owns 100% of Vinyl, Ltd., a foreign corporation and Digital, Inc., a domestic corporation. Music also owns 12% of Record, Inc., a domestic corporation. Music receives no distributions from any of these corporations. Which of these entities’ net income are included in Music’s income statement for current year financial reporting purposes?

Question 23

Which of the following items are not included in the income tax note for a publicly traded company?

Question 24

Which of the following represent temporary book-tax differences?

Question 25

North, Inc., earns book net income before tax of $500,000 in 2010. In computing its book income, North deducts $50,000 more in warranty expense for book purposes than allowed for tax purposes. North has no other temporary or permanent differences. Assuming the U.S. tax rate is 35% and no valuation allowance is required, what is North’s deferred income tax asset reported on its financial statements for 2010?

ACC 499 Final Exam Part 2 (Set 2)

Final Part 2 ACC 499 Capstone

Question 1

The AICPA Principles of Professional Conduct include which of the following?

Question 2

Which one of the following is an example of a conflict of interest for a CPA?

Question 3

Which of the following represents a situation in which an auditor is independent of the client?

Question 4

In which of the following situations would a CPA not be considered independent?

Question 5

The ethical framework derived from utilitarianism and rights theories indicates all of the following steps except

Question 6

Which of the following is included in the AICPA Code of Professional Conduct?

Question 7

Normally the auditor is not permitted to divulge confidential information obtained from a client. Which of the following situations would be a violation of this requirement?

Question 8

A member of the AICPA must safeguard the confidentiality of client information. Auditors, however, must disclose information to non-clients for the following reasons except to:

Question 9

Which of the following is a preventive control?

Question 10

An accounting system that maintains an adequate audit trail is implementing which internal control procedure?

Question 11

When duties cannot be segregated, the most important internal control procedure is

Question 12

The concept of reasonable assurance suggests that

Question 13

The most cost-effective type of internal control is

Question 14

The fundamental difference between internal and external auditing is that

Question 15

Substantive tests include

Question 16

The decision to extend credit beyond the normal credit limit is an example of

Question 17

Control risk is

Question 18

Which of the following represent temporary book-tax differences?

Question 19

North, Inc., earns book net income before tax of $500,000 in 2010. In computing its book income, North deducts $50,000 more in warranty expense for book purposes than allowed for tax purposes. North has no other temporary or permanent differences. Assuming the U.S. tax rate is 35% and no valuation allowance is required, what is North’s deferred income tax asset reported on its financial statements for 2010?

Question 20

How are deferred tax liabilities and assets categorized on the balance sheet?

Question 21

Hot, Inc.’s primary competitor is Cold, Inc. When comparing relative deferred tax asset and liability accounts with Cold, which of the following should Hot do?

Question 22

Paint, Inc., a domestic corporation, owns 100% of Blue, Ltd., a foreign corporation and Yellow, Inc., a domestic corporation. Paint also owns 40% of Green, Inc., a domestic corporation. Paint receives no distributions from any of these corporations. Which of these entities’ net income are included in Paint’s income statement for current year financial reporting purposes?

Question 23

Nocera, Inc. earns book net income before tax of $600,000 in 2010. Nocera acquires a depreciable asset in 2010 and first year tax depreciation exceeds book depreciation by $120,000. Nocera has no other temporary or permanent differences. Assuming the U.S. tax rate is 35%, what is Nocera’s total income tax expense reported on its financial statements for 2010?

Question 24

Which of the following items are not included in the income tax note for a publicly traded company?

Question 25

Larson, Inc., hopes to report a total book tax expense of $160,000 in the current year. This $160,000 expense consists of $240,000 in current tax expense and an $80,000 tax benefit related to the expected future use of an NOL by Larson. If the auditors determine that a valuation allowance of $30,000 must be placed against Larson’s deferred tax assets, what is Larson’s total book tax expense?

ACC 499 Final Exam Part 2 (Set 3)

Review Test Submission: Final Exam Part 2

Question 1

The ethical framework derived from utilitarianism and rights theories indicates all of the following steps except

Question 2

Mark Pulley is an auditor at Pulley and Hurst, LLC. If Pulley’s five-year-old daughter owns shares of stock in McBurgers Corporation, then Pulley is considered to have what type of interest in McBurgers Corporation?

Question 3

A member of the AICPA must safeguard the confidentiality of client information. Auditors, however, must disclose information to non-clients for the following reasons except to:

Question 4

Which of the following is not an aspect of Rule 201 of the General Standards of the Code of Professional Conduct?

Question 5

A CPA may only practice public accounting in which of the following forms?

Question 6

Which one of the following is an example of a conflict of interest for a CPA?

Question 7

Rule 201, dealing with General Standards that are applicable to all CPAs no matter the type of services that are rendered, does not include which factor?

Question 8

Independence is not required for which of the following types of services?

Question 9

Substantive tests include

Question 10

A physical inventory count is an example of a

Question 11

The importance to the accounting profession of the Sarbanes-Oxely Act is that

Question 12

The board of directors consists entirely of personal friends of the chief executive officer. This indicates a weakness in

Question 13

The decision to extend credit beyond the normal credit limit is an example of

Question 14

Control risk is

Question 15

The office manager forgot to record in the accounting records the daily bank deposit. Which control procedure would most likely prevent or detect this error?

Question 16

The concept of reasonable assurance suggests that

Question 17

Which of the following suggests a weakness in the internal control environment?

Question 18

Which of the following items are not included in the income tax note for a publicly traded company?

Question 19

North, Inc., earns book net income before tax of $500,000 in 2010. In computing its book income, North deducts $50,000 more in warranty expense for book purposes than allowed for tax purposes. North has no other temporary or permanent differences. Assuming the U.S. tax rate is 35% and no valuation allowance is required, what is North’s deferred income tax asset reported on its financial statements for 2010?

Question 20

Music, Inc., a domestic corporation, owns 100% of Vinyl, Ltd., a foreign corporation and Digital, Inc., a domestic corporation. Music also owns 12% of Record, Inc., a domestic corporation. Music receives no distributions from any of these corporations. Which of these entities’ net income are included in Music’s income statement for current year financial reporting purposes?

Question 21

Nocera, Inc. earns book net income before tax of $600,000 in 2010. Nocera acquires a depreciable asset in 2010 and first year tax depreciation exceeds book depreciation by $120,000. Nocera has no other temporary or permanent differences. Assuming the U.S. tax rate is 35%, what is Nocera’s total income tax expense reported on its financial statements for 2010?

Question 22

Which of the following represent temporary book-tax differences?

Question 23

Which of the following items are not included in the financial statement income tax note effective tax rate reconciliation?

Question 24

How are deferred tax liabilities and assets categorized on the balance sheet?

Question 25

Paint, Inc., a domestic corporation, owns 100% of Blue, Ltd., a foreign corporation and Yellow, Inc., a domestic corporation. Paint also owns 40% of Green, Inc., a domestic corporation. Paint receives no distributions from any of these corporations. Which of these entities’ net income are included in Paint’s income statement for current year financial reporting purposes?

ACC 499 Final Exam Part 2 (Set 4)

Question 1

A CPA may only practice public accounting in which of the following forms?

Question 2

A CPA firm is considered independent when it performs which of the following services for a publicly traded audit client?

Question 3

The AICPA Principles of Professional Conduct include which of the following?

Question 4

Which of the following is not an aspect of Rule 201 of the General Standards of the Code of Professional Conduct?

Question 5

In which of the following situations would a CPA not be considered independent?

Question 6

Which of the following is included in the AICPA Code of Professional Conduct?

Question 7

Mark Pulley is an auditor at Pulley and Hurst, LLC. If Pulley’s five-year-old daughter owns shares of stock in McBurgers Corporation, then Pulley is considered to have what type of interest in McBurgers Corporation?

Question 8

Which one of the following is an example of a conflict of interest for a CPA?

Question 9

An accounting system that maintains an adequate audit trail is implementing which internal control procedure?

Question 10

Which of the following suggests a weakness in the internal control environment?

Question 11

The most cost-effective type of internal control is

Question 12

When duties cannot be segregated, the most important internal control procedure is

Question 13

Substantive tests include

Question 14

Which of the following is a preventive control?

Question 15

The concept of reasonable assurance suggests that

Question 16

Inherent risk

Question 17

The office manager forgot to record in the accounting records the daily bank deposit. Which control procedure would most likely prevent or detect this error?

Question 18

North, Inc., earns book net income before tax of $500,000 in 2010. In computing its book income, North deducts $50,000 more in warranty expense for book purposes than allowed for tax purposes. North has no other temporary or permanent differences. Assuming the U.S. tax rate is 35% and no valuation allowance is required, what is North’s deferred income tax asset reported on its financial statements for 2010?

Question 19

Which of the following items are not included in the financial statement income tax note effective tax rate reconciliation?

Question 20

Which of the following represent temporary book-tax differences?

Question 21

Hot, Inc.’s primary competitor is Cold, Inc. When comparing relative deferred tax asset and liability accounts with Cold, which of the following should Hot do?

Question 22

Nocera, Inc. earns book net income before tax of $600,000 in 2010. Nocera acquires a depreciable asset in 2010 and first year tax depreciation exceeds book depreciation by $120,000. Nocera has no other temporary or permanent differences. Assuming the U.S. tax rate is 35%, what is Nocera’s total income tax expense reported on its financial statements for 2010?

Question 23

Which of the following items are not included in the income tax note for a publicly traded company?

Question 24

Which of the following taxes are included in the total income tax expense of a corporation reported on its Federal tax return?

Question 25

How are deferred tax liabilities and assets categorized on the balance sheet?

ACC 499 ACC499 ACC/499 ENTIRE COURSE HELP – ASHFORD UNIVERSITY

ACC 499 Midterm Exam Part 1 (4 Sets)

his Tutorial contains 4 Sets (All Question Listed below)

ACC 499 Midterm Part 1 (Set 1)

ACC 499 Midterm Part 1

Question 1

Which of the following is not a required disclosure by a lessee of an operating lease?

Question 2

Which of the following facts would require a lessee to classify a lease as a capital lease?

Question 3

When a lessor receives cash on an operating lease, which of the following accounts is increased?

Question 4

FASB’s rules concerning leases are an attempt to record in the financial statements

Question 5

As a generalized statement regarding lease accounting, which statement best describes U.S. versus international accounting principles?

Question 6

The account Unearned Interest: Leases should be reported on the lessor’s financial statements as

Question 7

Any initial direct costs incurred by the lessor for a lease agreement that is classified as an operating lease should be

Question 8

A direct financing lease differs from a sales-type lease in that

Question 9

A capital lease should be recorded in the lessee’s accounts at the inception of the lease in an amount equal to

Question 10

When a lessee makes periodic cash payments for an operating lease, which of the following accounts is increased?

Question 11

The lessee should classify a non-cancellable long-term lease as a capital lease if

Question 12

A lease will be treated as a direct financing lease by the lessor when

Question 13

The corporate form of organization is important to the U.S. economy because

Question 14

The authorized shares of capital stock is the number of shares

Question 15

In the financial statements, dividends in arrears on cumulative preferred stock should be

Question 16

In accounting for a stock split, a company usually

Question 17

Which of the following types of corporations is owned or operated by a government unit?

Question 18

Under the fair value method, the grant date is the date

Question 19

When recording the conversion of preferred stock into common stock, if the total contributed capital eliminated in regard to the preferred stock is less than the common stock par value, the difference is debited to

Question 20

Which of the following represents shares of stock that will be issued upon completion of an installment purchase contract?

Question 21

Common stock issued to employees through the exercise of stock warrants under a stock option plan that is classified as a noncompensatory stock option plan is recorded by the corporation at the

Question 22

Which set of accounting principles directly uses the term “reserve”?

Question 23

What account should be debited when stock issuance costs are associated with the initial issuance of stock at incorporation?

Question 24

A corporation is a legal entity

Question 25

Preferred stockholders share with common stockholders in any “extra” dividends when the preferred stock is

ACC 499 Midterm Part 1 (Set 2)

Question 1

Minimum lease payments do not include

Question 2

A direct financing lease differs from a sales-type lease in that

Question 3

When a lessee makes periodic cash payments for a capital lease, which of the following accounts is increased?

Question 4

Executory costs

Question 5

On January 1, Lessor Company incorrectly recorded a sales-type lease as an operating lease. As a result of this error, the reported amount for Lessor Company’s property, plant, and equipment leased to others is

Question 6

The lessee should classify a non-cancellable long-term lease as a capital lease if

Question 7

When a lessor receives cash on an operating lease, which of the following accounts is increased?

Question 8

Which of the following is not a required disclosure by a lessee of an operating lease?

Question 9

Which of the following facts would require a lessee to classify a lease as a capital lease?

Question 10

When a lessee makes periodic cash payments for a capital lease, which of the following accounts is decreased?

Question 11

Which of the following is not a required disclosure by a lessor of a sales-type lease?

Question 12

A capital lease should be recorded in the lessee’s accounts at the inception of the lease in an amount equal to

Question 13

When stock options are exercised by an employee under a compensatory stock option plan, the issuance of the common stock is recorded at the

Question 14

Under the cost method of accounting for treasury stock transactions, when the proceeds from a sale are greater than the cost, the excess over cost is treated as a(n)

Question 15

Which of the following represents shares of stock that will be issued upon completion of an installment purchase contract?

Question 16

Preferred stockholders share with common stockholders in any “extra” dividends when the preferred stock is

Question 17

A company is exchanging its common stock for land in a nonmonetary exchange. This transaction should be valued based upon the

Question 18

What account should be debited when stock issuance costs are associated with the initial issuance of stock at incorporation?

Question 19

When recording the conversion of preferred stock into common stock, if the total contributed capital eliminated in regard to the preferred stock is less than the common stock par value, the difference is debited to

Question 20

For stock appreciation rights (SARs) compensation plans where the employee is expected to receive cash on the exercise date, the account that is credited in the year-end adjusting journal entry to recognize the compensation expense is

Question 21

Dividends in arrears pertain to

Question 22

A non compensatory stock option plan is designed to

Question 23

The corporate form of organization is important to the U.S. economy because

Question 24

The preference to dividends that preferred stockholders have is

Question 25

A corporation is a legal entity

ACC 499 Midterm Part 1 (Set 3)

Review Test Submission: Midterm Exam Part 1

Question 1

The account Unearned Interest: Leases should be reported on the lessor’s financial statements as

Question 2

Any initial direct costs incurred by the lessor for a lease agreement that is classified as an operating lease should be

Question 3

The lessee should classify a non-cancellable long-term lease as a capital lease if

Question 4

When a lessor receives cash on an operating lease, which of the following accounts is increased?

Question 5

A capital lease should be recorded in the lessee’s accounts at the inception of the lease in an amount equal to

Question 6

Which is an advantage of leasing from a lessee’s viewpoint?

Question 7

The lessor should report the Lease Receivable for a sales-type lease on its balance sheet as

Question 8

When is it appropriate for the lessee to use the lessor’s implicit rate to discount the minimum lease payments?

Question 9

Minimum lease payments do not include

Question 10

A direct financing lease differs from a sales-type lease in that

Question 11

Executory costs

Question 12

Depreciation expense will be recorded in the accounts of the

Question 13

Which set of accounting principles directly uses the term “reserve”?

Question 14

When recording the conversion of preferred stock into common stock, if the total contributed capital eliminated in regard to the preferred stock is less than the common stock par value, the difference is debited to

Question 15

Dividends in arrears pertain to

Question 16

Common stock issued to employees through the exercise of stock warrants under a stock option plan that is classified as a non compensatory stock option plan is recorded by the corporation at the

Question 17

The value assigned to stock warrants for a non compensatory stock option plan is calculated as

Question 18

The corporate form of organization is important to the U.S. economy because

Question 19

A corporation whose stock is traded on a stock exchange is called a(n)

Question 20

The accounting method that is used for stock appreciation rights (SARs) compensation plans is similar to the accounting procedures that can be used for

Question 21

A company is exchanging its common stock for land in a nonmonetary exchange. This transaction should be valued based upon the

Question 22

The authorized shares of capital stock is the number of shares

Question 23

Universities, hospitals, and churches are examples of which type of corporation?

Question 24

In accounting for a stock split, a company usually

Question 25

A non compensatory stock option plan is designed to

ACC 499 Midterm Part 1 (Set 4)

Question 1

In a sales-type lease

Question 2

When is it appropriate for the lessee to use the lessor’s implicit rate to discount the minimum lease payments?

Question 3

When a lessee makes periodic cash payments for a capital lease, which of the following accounts is decreased?

Question 4

The lessor should report the Lease Receivable for a sales-type lease on its balance sheet as

Question 5

FASB’s rules concerning leases are an attempt to record in the financial statements

Question 6

When a lessor receives cash on a sales-type lease, which of the following accounts is decreased?

Question 7

A capital lease should be recorded in the lessee’s accounts at the inception of the lease in an amount equal to

Question 8

In a sales-leaseback transaction

Question 9

On January 1, Lessor Company incorrectly recorded a sales-type lease as an operating lease. As a result of this error, the reported amount for Lessor Company’s property, plant, and equipment leased to others is

Question 10

Any initial direct costs incurred by the lessor for a lease agreement that is classified as an operating lease should be

Question 11

Any initial direct costs incurred by the lessor for a sales-type lease should be

Question 12

Which of the following is not a required disclosure by a lessee of an operating lease?

Question 13

A corporation is a legal entity

Question 14

What account should be debited when stock issuance costs are associated with the initial issuance of stock at incorporation?

Question 15

The value assigned to stock warrants for a noncompensatory stock option plan is calculated as

Question 16

A noncompensatory stock option plan is designed to

Question 17

For stock appreciation rights (SARs) compensation plans where the employee is expected to receive cash on the exercise date, the account that is credited in the year-end adjusting journal entry to recognize the compensation expense is

Question 18

The authorized shares of capital stock is the number of shares

Question 19

A company is exchanging its common stock for land in a nonmonetary exchange. This transaction should be valued based upon the

Question 20

Common stock issued to employees through the exercise of stock warrants under a stock option plan that is classified as a noncompensatory stock option plan is recorded by the corporation at the

Question 21

When stock options are exercised by an employee under a compensatory stock option plan, the issuance of the common stock is recorded at the

Question 22

Preferred stockholders share with common stockholders in any “extra” dividends when the preferred stock is

Question 23

In accounting for a stock split, a company usually

Question 24

Which of the following types of corporations is owned or operated by a government unit?

Question 25

The corporate form of organization is important to the U.S. economy because

ACC 499 ACC499 ACC/499 ENTIRE COURSE HELP – ASHFORD UNIVERSITY

ACC 499 Midterm Exam Part 2 (3 Sets)

This Tutorial contains 3 Sets (All Question Listed Below)

ACC 499 Midterm Part 2 (Set 1)

Question 1

Accountants sometimes refer to the equity method as a(n)

Question 2

When an investor owns less than a majority of the voting stock of another corporation, the accountant must judge when the investor can exert significant influence. For the sake of uniformity, U.S. GAAP and IFRS presume that significant influence exists at ownership of _____ or more of the voting stock of the investee. (Assume that management does not have a contractual or other basis to demonstrate that influence.)

Question 3

U.S. GAAP view investments of between 20 and 50 percent of the voting stock of another company (unless evidence indicates that significant influence cannot be exercised) as

Question 4

When an investor uses the equity method to account for investments in common stock, cash dividends received by the investor from the investee should be recorded as

Question 5

U.S. GAAP view investments of less than 20 percent of the voting stock of another company as

Question 6

To avoid double counting P’s investment in S, P must eliminate

Question 7

The equity method of accounting for an investment in the common stock of another company should be used when the investment

Question 8

An intercompany transaction is a transaction between

Question 9

If the combined market value of trading securities at the end of the year is less than the market value of the same portfolio of trading securities at the beginning of the year, the difference should be accounted for by

Question 10

Intercompany sales

Question 11

A minority, active investment is generally

Question 12

Often, the parent does not own 100% of the voting stock of a consolidated subsidiary. The parent refers to the owners of the remaining shares of voting stock as a

Question 13

Which of the following is included in full IFRS but eliminated for SMEs’ IFRS?

Question 14

Which is one of the FASB/IASB convergence projects?

Question 15

Which of the following is not included in the income statement?

Question 16

Which of the following is not included in financial statements?

Question 17

Which point supports the use of IFRS by U.S. public companies?

Question 18

Which international organization began the movement toward international accounting standards?

Question 19

What is the correct order of steps in applying the revenue recognition model?(1) Identify the separate performance obligations in the contract(2) Identify the contract with the customer(3) Determine the transaction price for the entire contract(4) Recognize revenue when each separate performance obligation is satisfied(5) Allocate the transaction price to separate performance obligation

Question 20

Which is one of the key activities that will lead to a company’s successful IFRS conversion?

Question 21

Recoverable amount is the higher of the following:

Question 22

Which of the following are differences between U.S. GAAP and IFRS?

Question 23

Which of the following entities may not gain distinct advantages from adopting IFRS for SMEs?

Question 24

Which country is the only major country not to formally commit to the adoption of IFRS?

Question 25

Which of the following does IFRS require accounting students and educators to learn?

ACC 499 Midterm Part 2 (Set 2)

Question 1

A minority, active investment is generally

Question 2

An intercompany transaction is a transaction between

Question 3

Minority, passive investments are initially recorded at the

Question 4

To avoid double counting P’s investment in S, P must eliminate

Question 5

For which type of investments would unrealized increases and decreases be recorded directly in an owners’ equity account?

Question 6

Intercompany sales

Question 7

U.S. GAAP and IFRS require firms to account for minority, active investments, using the _____ method.

Question 8

U.S. GAAP view investments of between 20 and 50 percent of the voting stock of another company (unless evidence indicates that significant influence cannot be exercised) as

Question 9

Consolidated financial statements are typically prepared when one company has

Question 10

U.S. GAAP view investments of less than 20 percent of the voting stock of another company as

Question 11

U.S. GAAP and IFRS require firms to account for business combinations using the _____ method.

Question 12

When an investor owns less than a majority of the voting stock of another corporation, the accountant must judge when the investor can exert significant influence. For the sake of uniformity, U.S. GAAP and IFRS presume that significant influence exists at ownership of _____ or more of the voting stock of the investee. (Assume that management does not have a contractual or other basis to demonstrate that influence.)

Question 13

What is the major difference between how U.S GAAP and IFRS handle share-based payments?

Question 14

Which of the following does IFRS require accounting students and educators to learn?

Question 15

What is the appropriate reason why people object to adopting the roadmap?

Question 16

Recoverable amount is the higher of the following:

Question 17

What is the correct order of steps in applying the revenue recognition model?(1) Identify the separate performance obligations in the contract(2) Identify the contract with the customer(3) Determine the transaction price for the entire contract(4) Recognize revenue when each separate performance obligation is satisfied(5) Allocate the transaction price to separate performance obligation

Question 18

Which are two conditions that must be met before revenue is to be recognized under IFRS?

Question 19

Which one is not a characteristic of rules-based standards?

Question 20

Which point supports the use of IFRS by U.S. public companies?

Question 21

Which of the following is not a component of the Conceptual Framework for Financial Reporting?

Question 22

Which international organization began the movement toward international accounting standards?

Question 23

Which are two major differences between U.S. GAAP and IFRS in accounting for property, plant, and equipment (PPE)?

Question 24

Which of the following are differences between U.S. GAAP and IFRS?

Question 25

Which of the following is not included in financial statements?

ACC 499 Midterm Part 2 (Set 3)

Question 1

U.S. GAAP view investments of less than 20 percent of the voting stock of another company as

Question 2

When an investor uses the equity method to account for investments in common stock, cash dividends received by the investor from the investee should be recorded as

Question 3

If the combined market value of trading securities at the end of the year is less than the market value of the same portfolio of trading securities at the beginning of the year, the difference should be accounted for by

Question 4

When an investor owns less than a majority of the voting stock of another corporation, the accountant must judge when the investor can exert significant influence. For the sake of uniformity, U.S. GAAP and IFRS presume that significant influence exists at ownership of _____ or more of the voting stock of the investee. (Assume that management does not have a contractual or other basis to demonstrate that influence.)

Question 5

An intercompany transaction is a transaction between

Question 6

U.S. GAAP and IFRS require firms to account for minority, active investments, using the _____ method.

Question 7

To avoid double counting P’s investment in S, P must eliminate

Question 8

The equity method of accounting for an investment in the common stock of another company should be used when the investment

Question 9

Paula Company recognizes unrealized changes in the fair value of available-for-sale securities in

Question 10

For which type of investments would unrealized increases and decreases be recorded directly in an owners’ equity account?

Question 11

U.S. GAAP view investments of between 20 and 50 percent of the voting stock of another company (unless evidence indicates that significant influence cannot be exercised) as

Question 12

When preparing consolidated financial statements, the result of the elimination process generally is the

Question 13

Which is one criterion of SMEs?

Question 14

What is the correct order of steps in applying the revenue recognition model?(1) Identify the separate performance obligations in the contract(2) Identify the contract with the customer(3) Determine the transaction price for the entire contract(4) Recognize revenue when each separate performance obligation is satisfied(5) Allocate the transaction price to separate performance obligation

Question 15

Which of the following entities may not gain distinct advantages from adopting IFRS for SMEs?

Question 16

Which point supports the use of IFRS by U.S. public companies?

Question 17

Which of the following does IFRS require accounting students and educators to learn?

Question 18

Which is one of the key activities that will lead to a company’s successful IFRS conversion?

Question 19

Which are two major differences between U.S. GAAP and IFRS in accounting for property, plant, and equipment (PPE)?

Question 20

What is the major difference between how U.S GAAP and IFRS handle share-based payments?

Question 21

Which of the following is not included in the income statement?

Question 22

Which are two conditions that must be met before revenue is to be recognized under IFRS?

Question 23

Which of the following is included in full IFRS but eliminated for SMEs’ IFRS?

Question 24

Recoverable amount is the higher of the following:

Question 25

Which of the following is not included in financial statements?

ACC 499 ACC499 ACC/499 ENTIRE COURSE HELP – ASHFORD UNIVERSITY

ACC 499 Week 10 Assignment 3 Capstone Research Project (2 Papers)

This Tutorial contains 2 Different Papers

ACC 499 Week 10 Assignment 3: Capstone Research Project

Assume you are the partner in an accounting firm hired to perform the audit on a fortune 1000 company. Assume also that the initial public offering (IPO) of the company was approximately five (5) years ago and the company is concerned that, in less than five (5) years after the IPO, a restatement may be necessary. During your initial evaluation of the client, you discover the following information:

The client is currently undergoing a three (3) year income tax examination by the Internal Revenue Service (IRS). A significant issue involved in the IRS audit encompasses inventory write-downs on the tax returns that are not included in the financial statements. Because of the concealment of the transaction, the IRS is labeling the treatment of the write-down as fraud.

The company has a share-based compensation plan for top-level executives consisting of stock options. The value of the options exercised during the year was not expensed or disclosed in the financial statements.

The company has several operating and capital leases in place, and the CFO is considering leasing a substantial portion of the assets for future use. The current leases in place are arranged using special purpose entities (SPEs) and operating leases.

The company seeks to acquire a global partner, which will require IFRS reporting.

The company received correspondence from the Securities and Exchange Commission (SEC) requesting additional supplemental information regarding the financial statements submitted with the IPO.

Write an eight to ten (8-10) page paper in which you:

Evaluate any damaging financial and ethical repercussions of failure to include the inventory write-downs in the financial statements. Prepare a recommendation to the CFO, evaluating the negative impact of a civil fraud penalty on the corporation as a result of the IRS audit. In the recommendation, include essential internal control procedures to prevent fraudulent financial reporting from occurring, as well as the major obligation of the CEO and CFO to ensure compliance.

Examine the negative results on stakeholders and the financial statements of an IRS audit which generates additional tax and penalties or subsequent audits. Assume that the subsequent audit and / or additional tax and penalties result from the taxpayer’s use of an inventory reserve account, applying a 10 percent reduction to inventory over three (3) years.

Discuss the applicable federal tax laws, regulations, rulings, and court cases related to the inventory write-downs, and explain the specific relevance of each to the write-down.

Research the current generally accepted accounting principles (GAAP) regarding stock option accounting. Evaluate the current treatment of the company’s share-based compensation plan based on GAAP reporting. Contrast the financial benefits and risks of the share-based compensation stock option plan with the financial benefits and risks of a share-based stock-appreciation rights plan (SARS). Recommend to the CFO which plan the company should use, and provide the correct accounting treatment for each.

Research the reporting requirements for lease reporting under GAAP and International Financial Reporting Standards (IFRS). Based on your research, create a proposal for future lease transactions to the CFO. Within the proposal, discuss the use of off-the-balance sheet financing arrangements, capital leases, and operating leases, and indicate the related business and financial risks of each.

Create an argument for or against a single set of international accounting standards related to lease accounting based on the global market and cross border leases of assets. Examine the benefits and risks of your chosen position.

Examine the major implications of SAS 99 based on the factors you discovered during the initial evaluation of the company. Provide support for your rationale.

Analyze the potential for a material misstatement in the financial statements based on the issues identified in your initial evaluation. Make a recommendation to the CFO for the issuance of restated financial statement restatement. Identify at least three (3) significant issues that can result from the failure to issue restated financial statements.

Examine the economic effect of restatement of the financial statements on investors, employees, customers, and creditors.

Use five (5) quality academic resources in this assignment. Note: Wikipedia and other Websites do not qualify as academic resources.

Your assignment must follow these formatting requirements:

Be typed, double spaced, using Times New Roman font (size 12), with one-inch margins on all sides; citations and references must follow APA or school-specific format. Check with your professor for any additional instructions.

Include a cover page containing the title of the assignment, the student’s name, the professor’s name, the course title, and the date. The cover page and the reference page are not included in the required assignment page length.

The specific course learning outcomes associated with this assignment are:

Analyze accounting situations to apply the proper accounting rules and make recommendations to ensure compliance with generally accepted accounting principles.

Analyze business situations to determine the appropriateness of decision making in terms of professional standards and ethics

Use technology and information resources to research issues in accounting.

Analyze business situations and apply advanced federal taxation concepts.

Write clearly and concisely about accounting using proper writing mechanics.

ACC 499 ACC499 ACC/499 ENTIRE COURSE HELP – ASHFORD UNIVERSITY

ACC 499 Week 1 DQ 1 Operating and Capital Leases and DQ 2 Leasing Restatements

Week 1 Discussion 1

Operating and Capital Leases” Please respond to the following:

From the e-Activity, analyze the results of the proposed changes to lease accounting on operating and capital leases. Identifying how the right-of-use model will impact financial reporting, indicate how companies are likely to manage the change in reporting.

Discuss recommendations you would make to chief financial officers (CFOs) of retailers, service providers, and other businesses that lease several locations or have substantial leases of real estate or other assets. Indicate the pros and cons of each approach.

Week 1 Discussion 2

“Leasing Restatements in the Restaurant Industry” Please respond to the following:

From the case study, create an argument for the use of principles-based accounting for leases over rules-based accounting under GAAP, based on the financial statement restatements in the restaurant industry. Provide support for your argument.

Assess the materiality of the errors, direction provided by the Securities and Exchange Commission (SEC), and the Sarbanes-Oxley Act (SOX) on the decision by management to restate the financial statements. Indicate the likely impact to stakeholders when financial statements are restated.

ACC 499 ACC499 ACC/499 ENTIRE COURSE HELP – ASHFORD UNIVERSITY

ACC 499 Week 10 DQ 1 Taxes and DQ 2 Bethlehem Steel Corporation’s

Week 10 Discussion 1

“Taxes” Please respond to the following:

- From the e-Activity, create a scenario reflecting the differences between GAAP and international accounting standards for taxes. Determine which reporting standard best reflects financial reporting for taxes, and support your position.

- Examine the impact of FIN 48 (Accounting for the Uncertainty in income taxes) on GAAP reporting. Identify the benefits of the requirements on financial reporting. Assess whether FIN 48 was necessary, and support your position.

Week 10 Discussion 2

“Bethlehem Steel Corporation’s Deferred Taxes”Please respond to the following:

- From the case study, evaluate Bethlehem Steel’s valuation allowance in relation to the company’s ability to use deferred tax benefits in the future. Justify the position taken by Bethlehem Steel in the financial statements.

- From the case study, clarify the temporary differences identified in the tax footnote to Bethlehem Steel’s 2000 10-K due to employee benefits, depreciable assets, and the tax loss carried forward. Indicate what a user of the financial statement information can glean from reading the tax footnote to Bethlehem Steel’s 2000 10-K.

ACC 499 ACC499 ACC/499 ENTIRE COURSE HELP – ASHFORD UNIVERSITY

ACC 499 Week 11 DQ 1 Course Wrap-up and DQ 2 Application

Week 11 Discussion 1

“Course Wrap-Up” Please respond to the following:

- Discuss at least two topics covered in this course that expanded your knowledge of the topic.

- Explain how you plan to use this additional knowledge.

Week 11 Discussion 2

“Application” Please respond to the following:

- Discuss how the concepts from this course can be applied to your current or future accounting position.

- Discuss whether or not your feel prepared to enter the profession of Accounting. Identify what could help you further.

ACC 499 ACC499 ACC/499 ENTIRE COURSE HELP – ASHFORD UNIVERSITY

ACC 499 Week 2 DQ 1 Equity-Based Compensation and DQ 2 Harley-Davidson(B) 2010

Week 2 Discussion 1

“Equity-Based Compensation” Please respond to the following:

- From the e-Activity, discuss the impact of adopting IFRS reporting on equity-based accounting for financial reporting and tax payments. Then, recommend a strategy for companies adopting IFRS to minimize the impact of the accounting treatment.

- Examine the potential results of measuring the fair market value of the equity-based compensation at the grant date on financial statements under GAAP only. Provide recommendations you would make to minimize any distortions in fair market value

Week 2 Discussion 2

“Harley-Davidson(B) 2010” Please respond to the following:

- From the case study, examine the significant differences between the Harley-Davidson 2008 securitization and the 2009 securitization and the manner in which these differences are indicators of the financial health of the company. Examine the impact of the sub-prime mortgage on the securitization of Harley-Davidson.

- Analyze the debt-to-equity ratio of Harley-Davidson for 2008 and 2009, and discuss the impact these ratios had on the market value of the company. Propose at least two alternatives to additional securitization to finance current receivables, and provide a justification for each.

ACC 499 ACC499 ACC/499 ENTIRE COURSE HELP – ASHFORD UNIVERSITY

ACC 499 Week 3 Assignment 1 Amazon.com Business Combinations and Financial Results Analysis (2 Papers)

This Tutorial contains 2 Different Papers

ACC 499 Week 3 Assignment 1 – Amazon.com Business Combinations and Financial Results Analysis

Assignment 1: Amazon.com Business Combinations and Financial Results Analysis

Search the Internet for acquisitions and equity investments made by Amazon.com during the last five (5) years. Review the 10-K of Amazon.com located at http://www.sec.gov/cgi-bin/browse-

edgar?company=&match=&CIK=AMZN&filenum=&State

&Country=&SIC=&owner=exclude&Find=Find+Companies&action=getcompany.

Write a three to four (3-4) page paper in which you:

1. Examine how at least three (3) growth strategy alternatives utilized by Amazon.com in the global and domestic retail markets influenced profitability, and indicate if the strategies were successful.

2. Assess the financial value of the acquisitions and investments made by Amazon.com, and the influence of the acquisitions and investments on profitability during the accounting period.

3. Analyze the effect of the equity investments and impairments resulting from the acquisitions and investments by Amazon.com on the financial statements, and indicate whether or not the strategy was a creatable one. Provide support for your rationale.

4. Create an argument that growth in the European market can have a significant impact on current earnings and profit for Amazon.com. Provide support for your rationale.

5. Use at least two (2) quality academic resources in this assignment. Note: Wikipedia and other Websites do not qualify as academic resources.

ACC 499 ACC499 ACC/499 ENTIRE COURSE HELP – ASHFORD UNIVERSITY

ACC 499 Week 3 DQ 1 Global Mergers and Acquisitions and DQ 2 Sirius XM Radio

Week 3 Discussion 1

“Global Mergers and Acquisitions” Please respond to the following:

- From the e-Activity, contrast the impairment of goodwill on the financial statements of the entity reporting under international financial reporting standards (IFRS) that you researched with the impairment of goodwill on the financial statements of the same entity reporting under generally accepted accounting principles (GAAP). Indicate how stakeholders in the company are likely to react to the impairment. Provide support for your rationale.

- Examine the relationship between acquisition costs of the entity that you researched and the goodwill impairment charges related to the acquired entity. Indicate the most likely impact to the business.

Week 3 Discussion 2

From the case study, assess the major problems Sirius and XM radio faced during the acquisition of XM by Sirius as compared to the average acquisition during this period. Describe the key benefits of the acquisition to Sirius and XM.“Sirius XM Radio” Please respond to the following:

- Analyze the value of the Howard Stern’s show to Sirius XM Radio. Given your prediction of his continued success, provide a recommendation on contract extension for Stern based on his contribution to the financial stability of the company.

ACC 499 ACC499 ACC/499 ENTIRE COURSE HELP – ASHFORD UNIVERSITY

ACC 499 Week 4 DQ 1 Fair Value Accounting Under IFRS and DQ 2 Asset Impairments

Week 4 Discussion 1

“Fair Value Accounting Under IFRS” Please respond to the following:

- From the e-Activity, in terms of which takes precedence and provides the most information, evaluate the potential interaction of IFRS13 fair value measurement with other IFRS fair value measurement standards. Create an argument for the increased disclosure requirements under IFRS 13 as compared to other IFRS standards addressing fair value measurement. Provide support for your argument.

- Examine the main problems that an entity may encounter, and determine the highest and best use for fair value measurements under IFRS 13. Identify and provide alternative recommendations that can be used for determining fair value of assets when active markets are not available.

Week 4 Discussion 2

“Asset Impairments: The Recession of 2008-2009” Please respond to the following:

- From the case study, compare the disclosure notes provided in Nestle, Swatch Group, and Royal Bank of Scotland with the disclosure notes of News Corp and CBS Corporation. Explain which disclosure notes are more informative to the stakeholders in the evaluation of the financial statements.

- Contrast the difference between the impairment testing of goodwill and the impairment testing requirements for other assets. Examine the purpose of the differences identified in testing impairment of goodwill and other assets.

ACC 499 ACC499 ACC/499 ENTIRE COURSE HELP – ASHFORD UNIVERSITY

ACC 499 Week 5 DQ 1 Accounting for Pension Plans and DQ 2 General Motors

Week 5 Discussion 1

“Accounting for Pension Plans” Please respond to the following:

- From the e-Activity, create an argument for the use of the mark-to-market accounting method for pension accounting. Evaluate the impact of earnings volatility on financial reporting using mark-to-market accounting, and indicate whether or not you believe this is a fair representation of pension obligations.

- Defend the current GAAP rules for pension accounting reporting on the balance sheet and the income statement. Recommend a change you would make to the current pension accounting to more accurately reflect the future obligations of a company.

Week 5 Discussion 2

“General Motors” Please respond to the following:

- From the case study, assess the benefits and detriments of the U.S. Government-proposed bankruptcy plan that conserved General Motors’ liability to the United Auto Workers (UAW) pension and retiree health care fund. Indicate your agreement or disagreement with this approach. Provide support for your rationale.

- Examine the major advantages of transferring the post-retirement benefits to the UAW by General Motors. Indicate the likely impact to the company and its employees.

ACC 499 ACC499 ACC/499 ENTIRE COURSE HELP – ASHFORD UNIVERSITY

ACC 499 Week 6 DQ 1 Cyberattacks in Public Companies and DQ 2 Koss Corporation

Week 6 Discussion 1

“Cyberattacks in Public Companies” Please respond to the following:

- From the e-Activity, analyze the effects of the SEC‘s data breach disclosure requirement on financial reporting, based on the current language of the requirement. Recommend a change to the disclosure requirements to strengthen public company disclosures of cyberattacks. Provide support for your rationale.

- Examine the impact of cyberattacks on potential investors in a public company. As an auditor, provide your recommendations for including the potential of a cyberattack in the 10-K, as opposed to an actual attack. Provide support for your recommendation.

Week 6 Discussion 2

“Koss Corporation” Please respond to the following:

- From the case study, contrast the responsibilities of the independent auditor and board of directors with the responsibilities of Koss management for the embezzlement. Indicate the party that was ultimately responsible for the embezzlement. Provide support for your rationale.

- Recommend two controls that you would establish at Koss Corporation over electronic fund transfers. Indicate how each of the recommended controls would minimize the exposure to fraud in the future. Provide support for your recommendations.

ACC 499 ACC499 ACC/499 ENTIRE COURSE HELP – ASHFORD UNIVERSITY

ACC 499 WEEK 7 ASSIGNMENT 2 LITIGATION, CENSURES, AND FINES (2 Papers)

This Tutorial contains 2 Different Papers

ACC 499 WEEK 7 ASSIGNMENT 2 LITIGATION, CENSURES, AND FINES

Assignment 2: Litigation, Censures, and Fines

Research the Internet for recent litigation, censures, and fines involving national public accounting firms. Examples of litigation cases against national public accounting firms include fines by regulatory authorities and censures by professional societies.

Write a three to four (3-4) page paper in which you:

Analyze the primary accounting issues which form the crux of the litigation or fine for the firm, and indicate the impact to the firm as a result of litigation or fine. Provide support for your rationale.

Examine the key inferences of corporate ethics related to internal controls and accounting principles which lead to the litigation or fine for the accounting firm.

Evaluate the primary ethical standards of the accounting organization’s leadership and values which contributed to approval of the accounting issues and thus created the litigation or fines in question.

Identify specific conduct violations committed by the organization and accounting firm in question. Next, create an argument supporting the actions against the organization and accounting firm, based on the current professional code of conduct for independent auditors and management accountants.

Make a recommendation as to how regulators and professional societies may prevent this type of behavior in question for the future. Provide support for your rationale.

Use two (2) quality academic resources in this assignment. Note: Wikipedia and other Websites do not qualify as academic resources.

Your assignment must follow these formatting requirements:

Be typed, double spaced, using Times New Roman font (size 12), with one-inch margins on all sides; citations and references must follow APA or school-specific format. Check with your professor for any additional instructions.

Include a cover page containing the title of the assignment, the student’s name, the professor’s name, the course title, and the date. The cover page and the reference page are not included in the required assignment page length.

The specific course learning outcomes associated with this assignment are:

Analyze business situations to determine the appropriateness of decision making in terms of professional standards and ethics.

Use technology and information resources to research issues in accounting.

Write clearly and concisely about accounting using proper writing mechanics.

ACC 499 ACC499 ACC/499 ENTIRE COURSE HELP – ASHFORD UNIVERSITY

ACC 499 Week 7 DQ 1 Channel Stuffing and DQ 2 Carton Medical Devices

Week 7 Discussion 1

“Channel Stuffing” Please respond to the following:

- From the e-Activity, evaluate the requirements under GAAP related to channel stuffing practices on financial statements. Recommend key additional requirements, and justify those requirements.

- From the e-Activity, examine the impact of channel stuffing on financial reports used for internal decision making. Create a scenario involving a faulty internal decision based on channel stuffing.

Week 7 Discussion 2

“Carton Medical Devices”Please respond to the following:

- From the case study, determine how the standard cost system in Carton Medical Devices can be used for product costing and inventory valuation. Indicate the efficiencies that can be gained from the system.

- Examine the use of Carton‘s standard cost system in product costing for cost analysis, and indicate the intelligence that management is likely to gain using this approach.

ACC 499 ACC499 ACC/499 ENTIRE COURSE HELP – ASHFORD UNIVERSITY

ACC 499 Week 8 DQ 1 AICPA Code of Professional Conduct Violations

Week 8 Discussion 1

“AICPA Code of Professional Conduct Violations” Please respond to the following:

- From the e-Activity, discuss one violation of the AICPA Code of Professional Conduct leading to a disciplinary action. Explore the risks that relationships or circumstances played in the failure of the CPA to comply with the rules of the AICPA Code of Professional Conduct leading up to the violation.

- Examine current safeguards available to reduce the risks of the violation you identified. Discuss the specific safeguard you would recommend to reduce risks if confronted with a similar situation.

ACC 499 ACC499 ACC/499 ENTIRE COURSE HELP – ASHFORD UNIVERSITY

ACC 499 Week 9 DQ 1 Internal Controls and DQ 2 Apple, Inc

Week 9 Discussion 1

“Internal Controls” Please respond to the following:

- From the e-Activity, examine the importance of the audit committee oversight related to the quality of the internal controls of an organization. Analyze the audit committee’s responsibilities regarding risk assessment and internal control monitoring. Indicate whether or not the audit committee is the best to perform the function.

- Contrast the opinion provided by the independent auditor concerning management’s assessment of internal controls over the financial reporting system with the audit opinion on the financial statements in general. Argue for providing both a qualified opinion over the financial reporting system and an unqualified opinion on the financial statements.

Week 9 Discussion 2

“Apple, Inc.” Please respond to the following:

- From the case study, in 2009, the FASB issued a ruling related to income recognition from multiple element sales involving software to various stakeholder groups. Evaluate the impact of Apple’s retrospective restatement of its financial statements resulting from FASB’s ruling. Provide support for your rationale.

- From the case study, examine the influence of both Apple’s reported deferred revenue and the lobbying by Apple executives on FASB’s ruling. Indicate your agreement or disagreement with Apple’s attempt to influence FASB’s ruling.