AC 107 AC107 AC/107 ENTIRE COURSE HELP – ASHFORD UNIVERSITY

$149.99$275.00

AC 107 AC107 AC/107 ENTIRE COURSE HELP – ASHFORD UNIVERSITY

AC 107 Entire Course

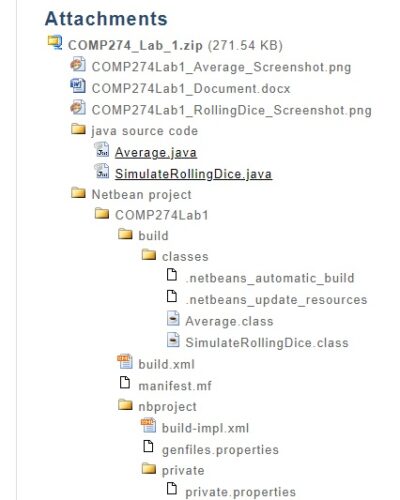

AC 107 Week 1 Unit 1 Assignment (Score 49.5/50)

AC 107 Week 1 Discussion

AC 107 Week 2 Unit 2 Assignment (Score 47/50)

AC 107 Week 2 Discussion

AC 107 Week 3 Unit 3 Assignment (Score 40/50)

AC 107 Week 4 Unit 4 Key Assessment

AC 107 Week 4 Discussion

AC 107 Week 5 Unit 5 Assignment (Score 48/50)

AC 107 Week 5 Discussion

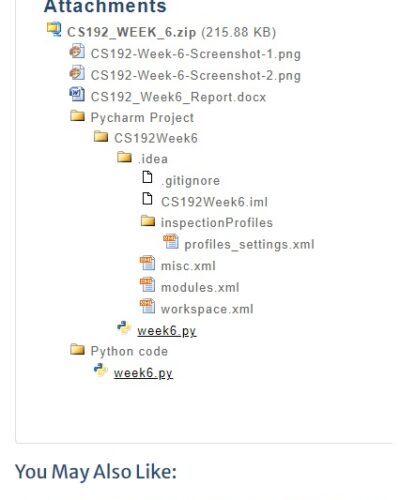

AC 107 Week 6 Unit 6 Assignment (Score 45/50)

AC 107 Week 7 Discussion

AC 107 Week 7 Unit 7 Key Assessment CLO 3

AC 107 Final Exam Guide (100% Score)

AC 107 Week 1 Quiz (100% Score)

AC 107 Week 2 Quiz (100% Score)

AC 107 Week 3 Quiz (100% Score)

AC 107 Week 4 Midterm Exam (100% Score)

AC 107 Week 5 Quiz (100% Score)

AC 107 Week 6 Quiz (100% Score)

Description

AC 107 AC107 AC/107 ENTIRE COURSE HELP – ASHFORD UNIVERSITY

AC 107 Entire Course

AC 107 Week 1 Unit 1 Assignment (Score 49.5/50)

AC 107 Week 1 Discussion

AC 107 Week 2 Unit 2 Assignment (Score 47/50)

AC 107 Week 2 Discussion

AC 107 Week 3 Discussion

AC 107 Week 3 Unit 3 Assignment (Score 40/50)

AC 107 Week 4 Unit 4 Key Assessment

AC 107 Week 4 Discussion

AC 107 Week 5 Unit 5 Assignment (Score 48/50)

AC 107 Week 5 Discussion

AC 107 Week 6 Unit 6 Assignment (Score 45/50)

AC 107 Week 7 Discussion

AC 107 Week 7 Unit 7 Key Assessment CLO 3

AC 107 Final Exam Guide (100% Score)

AC 107 Week 1 Quiz (100% Score)

AC 107 Week 2 Quiz (100% Score)

AC 107 Week 3 Quiz (100% Score)

AC 107 Week 4 Midterm Exam (100% Score)

AC 107 Week 5 Quiz (100% Score)

AC 107 Week 6 Quiz (100% Score)

AC 107 AC107 AC/107 ENTIRE COURSE HELP – ASHFORD UNIVERSITY

AC 107 Week 1 Unit 1 Assignment (Score 49.5/50)

UNIT 1 VOCABULARY MATCHING

IN THE BOX PROVIDED NEXT TO EACH VOCABULARY TERM RECORD THE LETTER OF ITS DEFINITION

Term Definition

1. Account A. Three fundamental elements: Assets = Liabilities + Owner’s Equity

2. Accounts Payable B. Reports assets, liabilities, and owner’s equity on a specific date.

Confirms that the accounting equation is in balance.

3. Accounts Receivable C. Concept that non-business assets and liabilities are not included in

the business records.

4. Accounting Equation D. The costs of doing business. Costs incurred for the purpose of earning revenue.

5. Assets E. Withdrawals by the owner that reduce capital by withdrawing cash or

other assets for personal use.

6. Balance Sheet F. A business that makes a product to sell.

7. Business Entity Concept G. A record where we collect information that is similar. For example, all increases and decreases in the bank balance are recorded in the Cash account.

8. Corporation H. Ownership structure in which more than one person owns the business.

9. Expenses I. An act passed by Congress to help improve reporting practices of public companies.

10. GAAP J. Unwritten promise to pay a supplier for purchases or services received.

11. Income Statement K. A type of ownership structure in which stockholders own the business.

12. Liabilities L. Generally Accepted Accounting Principles. Procedures and guidelines developed by FASB to be followed in the accounting and reporting process.

13. Manufacturing Business M. Reports revenue, expenses, and net income or net loss.

14. Merchandising Business N. A business that buys products to sell.

15. Net Income (Profit) O. Amount the business charges its customers for services or products sold.

16. Owner’s Name, Drawing P. A business that earns revenue by providing a service rather than a product.

17. Owner’s Equity (Capital) Q. Excess of total revenues over total expenses. Revenues are greater than expenses.

18. Partnership R. Ownership structure in which only one person owns the business.

19. Revenue S. The category where we record amounts owed by a business to another business or individual (Debts).

20. Sarbanes-Oxley Act T. Reports beginning capital, plus net income, less withdrawals to compute ending capital for an accounting period

21. Service Business U. Amount owed to a business by its customers for the sale of goods or services.

22. Sole Proprietorship V. The amount by which business assets are greater than liabilities.

23. Statement of Owner’s Equity W. Items owned by the business that will provide future benefits.

ACCOUNTING ELEMENTS

Click on the CLASSIFICATION box next to the account name, then click on the arrow

to see the dropdown list and identify each of the accounts as an asset, iability,

owner’s equity, revenue or expense account. Then click on the FINANCIAL STATEMENT

box next to the account to see the dropdown list and identify the statement where

this account is reported. The chart of account handout (tab in this assignment file)

is an excellent resource to use to check your answers!

Asset

Liability Income Statement

Owner’s Equity Statement of Owner’s Equity

Revenue Balance Sheet

Expense

ACCOUNT CLASSIFICATION FINANCIAL STATEMENT

Cash

Rent Expense

Accounts Payable

Accounts Receivable

Service Fees Revenue

Office Equipment

Supplies

Wages Expense

Wages Payable

Prepaid Insurance

John Smith, Drawing

John Smith, Capital

IDENTIFYING AFFECTED ACCOUNTS.

Every business transaction will affect at least two accounts in the financial records. This

week each one will affect TWO and ONY TWO accounts. For each of the transactions below

AC 107 AC107 AC/107 ENTIRE COURSE HELP – ASHFORD UNIVERSITY

AC 107 Week 1 Discussion

Discussion Questions

- Who’s Who in Accounting:

- Who is the SEC? What is their role in the financial markets of the United States?

- Who is the FASB? What is their role in accounting and the preparation of financial reports?

- In your own words explain what is meant by Generally Accepted Accounting Principles.

- Who is the IASB? Do you think that the United States should change its rules for accounting in order to meet the goal of requiring uniform financial statements throughout the world?

- In light of the recession of 2008/2009 and economic problems created during that time, do you think that the SEC was doing a good job? Why or why not?

- What is the Purpose of Accounting:

- What is the purpose of Accounting?

- Identify and describe the four user groups normally interested in financial information. What kind of information is needed by each of these groups?

- There are several professional certifications available to accountants. Explain the roles of the Certified Public Accountant (CPA), Certified Management Accountant (CMA), and Certified Internal Auditor (CIA).

- If you were planning a career in accounting which of these certifications would you be interested in earning? Why?

- Would you Like to Own your Own Business (Optional for secondary posting): Have you ever considered owning your own business? If so, what business would it be? Would it be a service, merchandising, or manufacturing business? Explain what form of ownership structure you would prefer and why.

AC 107 AC107 AC/107 ENTIRE COURSE HELP – ASHFORD UNIVERSITY

AC 107 Week 2 Unit 2 Assignment (Score 47/50)

VOCABULARY MATCHING

IN THE BOX PROVIDED NEXT TO EACH VOCABULARY TERM RECORD THE LETTER OF ITS DEFINITION

Term Definition

1. Account balance A. A day-by-day listing of the transactions of a business.

2. Chart of accounts B. The side of an account where an increase is recorded.

3. Credit C. This balance shows the ending amount calculated in an account.

It is the difference between the footings of an account in a t-account

and also the ending balance in the general ledger.

4. Debit D. To post to the right side of an account.

5. General ledger E. A list of all accounts and their balances to prove the equality of

debits and credits.

6. Journal F. A complete set of all accounts used by a business. It accumulates the

complete record of the debits and credits made to the account.

maintains the running balance.

7. Normal balance G. Any document that provides information about a business transaction.

8. Posting H. To post to the left side of an account.

9. Source document I. A list of all accounts used by a business.

10. Trial balance J. Copying the debits and credits from the journal to the ledger.

DEBIT AND CREDIT ANALYSIS

Click on the debit/credit box next to the account change, then Select:

click on the arrow to see the dropdown list and identify

whether the change will be recorded with a debit or a credit. debit

credit

Hint: The Normal Balance Handout that is provided as a tab in this assignment

file and in the Week 2 Learning Activities folder is an excellent reference to help

you with this assignment.

(a) The asset account Cash is increased with a

(b) The liability account Accounts Payable is increased with a

(c) The asset account Cash is decreased with a

(d) The revenue account Delivery Fees is increased with a

(e) The owner’s Drawing account is increased with a

(f) The asset account Accounts Receivable is increased with a

(g) The Rent Expense account is increased with a

(h) The owner’s Capital account is increased with a

(i) The Prepaid Insurance asset account is increased with a

EXERCISES 4-4A & 4-5A

Complete Exercises 4-4A and 4-5A found on pp. 115 & 116 of your textbook.

Post the account names and the debit and credit amounts. Some of the account names

are provided. Fill in the names of the missing accounts and the account numbers as the

posting reference. You will find these in the question on page 117. The dates and

descriptions have also been provided. After the journal is completed, post the transactions

to the general ledger in the ‘Ledger’ tab, and then prepare the trial balance in the

Trial Balance’ tab.

The first journal entry has been completed as an example for you to follow. Please note

the following formatting rules:

1. In this exercise two accounts are affected by each transaction. One account is given to &nb

AC 107 AC107 AC/107 ENTIRE COURSE HELP – ASHFORD UNIVERSITY

AC 107 Week 2 Discussion

Discussion Questions

- Analyzing Financial Transactions: In Chapter 4 of your text, pages 90 – 93, carefully review the accounting transactions for Rohan’s Campus Delivery and how they are entered in the general journal. Before you begin please watch the video demonstrations of the completion of these journal entries in the Week 2 Classroom.

Once you understand how these journal entries are prepared, please select one transaction from the list of transactions for Barry Bird Basketball Camp in the Mastery Problem on pages 125-126 and answer the questions below for that transaction. There are 23 journal entries in this problem, so each of you must select an entry that has not been completed by a classmate! First come, first served! Please be sure to identify your entry by the date of the transaction and provide your response in your own words. One helpful way to reach the minimum 250-word count requirement is to define any new terms or explain any new concepts that you are using.- What happened? (Describe the transaction)

- Which two accounts are affected by this transaction? Are they increased or decreased?

- What type of accounts is each of the two that are affected (assets, liabilities, owner’s equity, revenue, expense)?

- What is the normal balance of each of these two accounts? (Normal debit balance or normal credit balance?)

- In the journal entry, which account is debited and which account is credited?

- Ethics Question: Bob Jones owns a small business as a sole proprietor. One day he used the company debit card to fill up the gas tank in his wife’s car that was not used for business purposes. Using a debit card takes money out of his bank account immediately. He told his bookkeeper to record a debit for the $40 charge to the account “Auto Expense” and to record the credit to Cash.

- What account should the gas have been debited to?

- What account would be credited?

- What accounting concept has been violated? (Hint: Check your vocabulary matching exercise in the Week 1 Assignment.)

- How will this transaction affect the income statement for this month?

- Do you think this is ethical? Why or why not?

Discussion Questions

- Adjusting Journal Entries: Note: Before you answer this question be sure to review the information about these journal entries in your text and the video presentations and the supplementary materials. Select one of the four following types of adjustments and answer all of the questions below as they relate to the adjustment you have chosen. Remember, your primary posting must be a short answer essay of at least 250 words that fully explains each part of the question.

- Record depreciation expense

- Adjust for supplies usage

- Adjust prepaid insurance

- Accrue wages earned but not yet paid

- Why is this adjusting journal entry prepared?

- Which accounts are affected? Are they increased or decreased?

- Which account is debited and which one is credited? How do we determine the amount of the adjustment debit and credit?

- Are the affected accounts assets, liabilities, owner’s equity, revenue, or expense accounts?

- Are these accounts reported on the income statement, statement of owner’s equity, or the balance sheet?

- Cash vs. Accrual Accounting: Explain the difference between the cash basis, modified cash basis, and the accrual basis measures of performance. Provide examples of accounts that are treated differently under the three methods. Be sure to review the related PowerPoint Presentation in the Unit 3 Presentations/Lectures and in the Supplementary Materials.

- Why, in most cases, does accrual basis net income provide a better measure of performance than cash basis net income?

- Explain the purpose of adjusting entries as they relate to the difference between cash and accrual accounting. Which generally accepted accounting principle (GAAP) rule does accrual accounting fulfill

Financial Statements: This question MAY NOT be used as your primary posting. It may be answered only as a secondary or reply post with a minimum 100-wordcount requirement. The three primary financial statements that we have seen so far are the Balance Sheet, Statement of Owner’s Equity, and the Income Statement. Please describe which account categories belong on which statement and identify them as temporary or permanent accounts. These statements must be prepared in a particular order. Which statements are prepared first, second, and third? Why do we have to prepare them in this order?

Generally Accepted Accounting Principles: This question MAY NOT be used as your primary posting. It may be answered only as a secondary or reply post with a minimum 100-word count requirement.This week we have learned about four of the generally accepted accounting principles – revenue recognition, expense recognition, the matching principle, and the historical cost principle. Briefly explain what is meant by each of these and how they are applied to accrual accounting.

AC 107 AC107 AC/107 ENTIRE COURSE HELP – ASHFORD UNIVERSITY

AC 107 Week 3 Discussion

Discussion Questions

- Adjusting Journal Entries: Note: Before you answer this question be sure to review the information about these journal entries in your text and the video presentations and the supplementary materials. Select one of the four following types of adjustments and answer all of the questions below as they relate to the adjustment you have chosen. Remember, your primary posting must be a short answer essay of at least 250 words that fully explains each part of the question.

- Record depreciation expense

- Adjust for supplies usage

- Adjust prepaid insurance

- Accrue wages earned but not yet paid

- Why is this adjusting journal entry prepared?

- Which accounts are affected? Are they increased or decreased?

- Which account is debited and which one is credited? How do we determine the amount of the adjustment debit and credit?

- Are the affected accounts assets, liabilities, owner’s equity, revenue, or expense accounts?

- Are these accounts reported on the income statement, statement of owner’s equity, or the balance sheet?

- Cash vs. Accrual Accounting: Explain the difference between the cash basis, modified cash basis, and the accrual basis measures of performance. Provide examples of accounts that are treated differently under the three methods. Be sure to review the related PowerPoint Presentation in the Unit 3 Presentations/Lectures and in the Supplementary Materials.

- Why, in most cases, does accrual basis net income provide a better measure of performance than cash basis net income?

- Explain the purpose of adjusting entries as they relate to the difference between cash and accrual accounting. Which generally accepted accounting principle (GAAP) rule does accrual accounting fulfill

Financial Statements: This question MAY NOT be used as your primary posting. It may be answered only as a secondary or reply post with a minimum 100-wordcount requirement. The three primary financial statements that we have seen so far are the Balance Sheet, Statement of Owner’s Equity, and the Income Statement. Please describe which account categories belong on which statement and identify them as temporary or permanent accounts. These statements must be prepared in a particular order. Which statements are prepared first, second, and third? Why do we have to prepare them in this order?

Generally Accepted Accounting Principles: This question MAY NOT be used as your primary posting. It may be answered only as a secondary or reply post with a minimum 100-word count requirement.This week we have learned about four of the generally accepted accounting principles – revenue recognition, expense recognition, the matching principle, and the historical cost principle. Briefly explain what is meant by each of these and how they are applied to accrual accounting.

AC 107 AC107 AC/107 ENTIRE COURSE HELP – ASHFORD UNIVERSITY

AC 107 Week 3 Unit 3 Assignment (Score 40/50)

journal Entires

This comprehensive problem is intended to serve as a mini-practice set without the source documents. As such, students should plan on about three to four hours to complete this problem.

The following transactions took place during April 20–.

Requried; Journal the following April entires in the general jouranl provided in colums M-Q

Apr. 1 Night invested cash in business, $90,000.

1 Paid insurance premium for six-month camping season, $9,000.

2 Paid rent for lodge and campgrounds for the month of April, $40,000.

2 Deposited registration fees, $35,000.

2 Purchased 10 fishing boats on account for $60,000. The boats have estimated useful lives of five years, at which time they will be donated to a local day camp. Arrangements were made to pay for the boats in July.

3 Purchased food supplies from Acme Super Market on account, $7,000.

5 Purchased office supplies from Gordon Office Supplies on account, $500.

7 Deposited registration fees, $38,600.

10 Purchased food supplies from Acme Super Market on account, $8,200.

10 Paid wages to fishing guides, $10,000.

14 Deposited registration fees, $30,500.

Apr. 16 Purchased food supplies from Acme Super Market on account, $9,000.

17 Paid wages to fishing guides, $10,000.

18 Paid postage, $150.

21 Deposited registration fees, $35,600.

24 Purchased food supplies from Acme Super Market on account, $8,500.

24 Paid wages to fishing guides, $10,000.

28 Deposited registration fees, $32,000.

29 Paid wages to fishing guides, $10,000.

30 Purchased food supplies from Acme Super Market on account, $6,000.

1 Post the transaction from General Journal in Tab 1 in the ledger accounts below.

2 Go to tab 3 and see if Col b and C balance. If they do you have posted everything correctly

If they do not balance, you will need to find your posting error in the general ledger below.

When you balance go to step 3

3 Go to Tab 4 and journal the adjusting entries

4 Come back to Tab 2 and post adjusting entries

in the orange rows.

5 Post the adjusting entries in the worksheet in Tab 3 in col D and E

6 In the Worksheet (Tab 3) create an Adjusted Trial Balance.

by netting the debits and credits from the trial balance and the adjusting entries in the adjusted trail balance columns.

Adjusting Entries

a Office Supp;lies on hand $100

b Food Supplies remaining on hand $8000

c Insurance expired during the month of April $1500

d Depreciation on Fishing Boats for April $1000

AC 107 AC107 AC/107 ENTIRE COURSE HELP – ASHFORD UNIVERSITY

AC 107 Week 4 Unit 4 Key Assessment

For this key assessment, please identify the ten (10) steps in the accounting cycle and explain the purpose of each step in a short paragraph. As you are writing please keep in mind that the question is asking for the purpose of each step, not how it is completed! When thinking about the purpose of a step consider why we are completing it or what it tells us after it is completed. Be sure that you consider the steps that we learned about in chapters 1-6 and not those from an Internet website which may be somewhat different.

Please complete the essay on a Word document and upload it here. It may be completed in a listing format rather than APA style. Don’t forget to use complete sentences and correct spelling and grammar. Explanations must be in your own words

AC 107 AC107 AC/107 ENTIRE COURSE HELP – ASHFORD UNIVERSITY

AC 107 Week 4 Discussion

Discussion Questions

- Internal Controls: There are five components of internal control:

- Control environment

- Risk assessment

- Control activities

- Information and communication system

- Monitoring processes.

In your own words explain the purpose of internal controls. Then select one of the components shown above and explain the role it plays in protecting the assets of the business. Many of these activities can be observed in the workplace both inside and outside of the accounting department. Please share any work experiences you may have had with these activities or any that you have observed in other businesses, even if they are not in the accounting department. Be sure to provide a reference for any material used from a source.

Extra Questions: Bank Teller Ethics: Note: This question may not be used as your primary posting. It may be answered only as a secondary or reply post with a minimum 100-word count requirement.

Ben Thomas works as a teller for First National Bank. When he arrived at work on Friday, the branch manager, Frank Mills, asked him to get his cash drawer out early because the head teller, Naomi Ray, was conducting a surprise cash count for all of the tellers. Surprise cash counts are usually done four or five times a year by the branch manager or the head teller and once or twice a year by internal auditors.

Ben’s drawer was $100 short and his reconciliation tape showed that he was in balance on Thursday night. Naomi asked Ben for an explanation, and Ben immediately took $100 out of his pocket and handed it to her. He went on to explain he needed the cash to buy prescriptions for his son and for groceries and intended to put the $100 back in his cash drawer on Monday, which was payday. He also told Naomi that this was the first time he had ever “borrowed” money from his cash drawer and that he would never do it again.

The American Institute of Certified Public Accountants (AICPA) presents these steps in the ethical decision-making process:

- Recognize issues when they arise.

- Gather critical facts.

- Identify the stakeholders.

- Consider the alternative solutions.

- Consider the effects of the decision on the stakeholders.

- Consider your comfort level with the alternatives.

- Consider the rules, regulations, and laws.

- Make the decision.

- Document your efforts.

- Evaluate the outcome.

Based on the steps please answer the following questions.

- What are the ethical considerations in this case from both Ben’s and Naomi’s perspectives?

- Who are the stakeholders who may be impacted by Naomi’s decision about how to handle this situation?

- What options does Naomi have to address the problem?

- What do you think Naomi should do?

References:

Heintz, J. & Parry, R. (2016). College Accounting (22nd ed.). Mason: Thompson/South-Western.

AC 107 AC107 AC/107 ENTIRE COURSE HELP – ASHFORD UNIVERSITY

AC 107 Week 5 Unit 5 Assignment (Score 48/50)

VOCABULARY MATCHING – SALES AND PURCHASES

IN THE BOX PROVIDED BY EACH VOCABULARY TERM RECORD THE LETTER OF ITS DEFINITION

You can research these terms at the end of the chapters and in the glossary.

Term Definition

1. Cash discounts A. A summary account maintained in the general ledger with a subsidiary ledger.

2. Contra-cost account B. Shipping terms indicating that transportation charges are paid by the seller.

3. Contra-revenue account C. The expense account used to record the acquisition of goods for resale.

4. Controlling account D. Discounts to encourage prompt payment by customers who buy merchandise

on credit.

5. Trade discount E. A separate ledger made up of individual accounts that contain the details of a

controlling account.

6. FOB Destination F. An account with a debit balance that is deducted from the related revenue account.

7. FOB Shipping Point G. An account with a credit balance that is deducted from the related purchases account.

8. Subsidiary ledger H. Shipping terms indicating that transportation charges are paid by the buyer.

9. Purchases account I. A reduction in the price of merchandise granted by the seller because of

defects or other problems with the merchandise

10. Sales allowance J. A reduction from the list or catalog price offered to different classes of customers.

PROBLEM 10-11A & 10-12A – SOURK DISTRIBUTORS

Complete Problems 10-11A & 10-12A found on page 388-389 of your textbook.

Record the account names, the debit OR credit amount, and the posting references.

Some of the account names are provided. If you cannot locate a checkmark symbol for the

posting reference use a lower case “x”. The dates and descriptions have also been provided.

After the entry is completed, post the Accounts Receivable transactions (only) to the general

ledger and then to the Accounts Receivable ledger in the next exercise. After completing the

Accounts Receivable ledger complete the Schedule of Accounts Receivable.

The posting reference should be completed for the Accounts Receivable entries only for

both the general ledger and the accounts receivable ledger.

122 Accounts Receivable

REMEMBER – TOTAL DEBITS MUST EQUAL TOTAL CREDITS IN EVERY TRANSACTION!

Here’s a hint: When the customer pays an invoice after some of the goods have been returned

subtract the selling price of the goods returned from the selling price of goods on the original

invoice. Then calculate sales tax payable on the price of the goods that the customer kept. The

customer will pay for the total of the remaining goods plus the sales tax on those goods.

DATE ACCOUNTS & DESCRIPTIONS POST REF dr cr

J.1 Mar. 1 Accounts Receivable / Donachie& Co.

Sale on account No. 33C to Donachie& Co., $1,700 plus sales tax.

DATE ACCOUNTS & DESCRIPTIONS POST REF dr cr

J.2 Mar. 3

Sales Revenue

Sale on account No. 33D to R.J. Kibubu, Inc., $2,190 plus sales tax.

DATE ACCOUNTS & DESCRIPTIONS POST REF dr cr

J.3 Mar. 5 Sales Returns and Allowances

Donachie& Co. returned merchandise from Sale No. 33C for a credit memo (CM 66)

of $40 plus sales tax.

&

AC 107 AC107 AC/107 ENTIRE COURSE HELP – ASHFORD UNIVERSITY

AC 107 Week 5 Discussion

Discussion Questions

- Journal Entries for Sales and Cash Receipts: Note: One way to meet the 250-word minimum requirement for your primary post is to define the new terms that you are using. Before you begin, review the preparation of journal entries in the Demonstration Problem on pages 375 – 381 and the video demonstrations in the Unit 5 Resources explaining the preparation of sales journal entries. Once you understand how these journal entries are prepared, select one transaction from Problem 10-11B on page 393 of the text, for Paul Jackson’s retail store and answer the questions below for that transaction. Note: Each of you must select an entry that has not been completed by a classmate! If all the journal entries have been chosen, select one from the Chapter 11 discussion question. First come, first served! Please be sure to identify your entry by the date of the transaction and provide your response in your own words. Remember, the primary posting is a short answer essay that fully explains your responses.

- What happened? (Describe the transaction)

- Which accounts are affected by this transaction? Are they increased or decreased?

- What is the normal balance of each of these accounts?

- Which accounts are debited and by what amount? Explain how you arrived at that amount.

- Which accounts are credited and by what amount? Explain how you arrived at that amount.

- Journal Entries for Purchases and Cash Payments: Note: One way to meet the 250-word minimum requirement for your primary post is to define the new terms that you are using. Review the preparation of journal entries in the Demonstration problem on pp. 418-421 and the demonstration video in the Unit 5 Resources explaining the preparation of journal entries for purchase transactions. Once you understand how these journal entries are prepared, please select one transaction from Problem 11-11B, on page 433 of the text, for Debbie’s Doll House, and answer the questions below for that transaction. There are 12 journal entries in this problem, but each of you must select an entry that has not been completed by a classmate! If all of the journal entries have been prepared select an entry from the Chapter 10 discussion question. First come, first served! Please be sure to identify your entry by the date of the transaction and provide your response in your own words. Remember, the primary posting is a short answer essay that fully explains your responses.

- What happened? (Describe the transaction)

- Which accounts are affected by this transaction? Are they increased or decreased?

- What is the normal balance of each of these accounts?

- Which accounts are debited and by what amount? Explain how you arrived at that amount.

- Which accounts are credited and by what amount? Explain how you arrived at that amount.

- Sales Ethics: Note: This question may not be used as your primary posting. It may be answered only as a secondary or reply post with a minimum 100-word count requirement. Barbara’s Brownies produces different varieties of brownies that she sells to grocery, candy, and gift shops. These sales are made with the terms FOB shipping point, and she generally ships the brownies on the same day that the order is received or on the next day if necessary. The company’s fiscal year end is December 31. During the last week of December Barbara takes a look at her financial reports before deciding when to ship orders received that week. If sales and profits for the month and year have been good, she may delay shipments until early January. If sales and profits have been poor, she will deliver all that she can in December.

- With terms of FOB shipping point, when does Barbara record a sale? If she ships in January and records the sale in January has she violated any accounting rules?

- Do you think it is ethical for Barbara to delay shipments until the next year? Why or why not? Who may be harmed by that decision?

- What impact will delaying the recording of sales until January have on her financial statements for December and January? Who may be harmed by that decision?

AC 107 AC107 AC/107 ENTIRE COURSE HELP – ASHFORD UNIVERSITY

AC 107 Week 6 Unit 6 Assignment (Score 45/50)

VOCABULARY MATCHING – INVENTORY

IN THE BOX PROVIDED BY EACH VOCABULARY TERM RECORD THE LETTER OF ITS DEFINITION

You can research these terms at the end of the chapters and in the glossary.

Term Definition

1. Conservatism A. A method of allocating merchandise cost based on the average cost of identical units.

2. Consistency B. An inventory valuation rule which requires that inventory is valued at the lower

of its cost or its replacement price.

3. First-in, First-out (FIFO) C. Under this system the merchandise inventory and cost of goods sold accounts are updated

whenever merchandise is bought or sold.

4. Gross profit D. This accounting principle says that a business should use the same accounting methods

from period to period. This improves comparability of financial statements over time.

5. Last-in, First-out (LIFO) E. A method of allocating merchandise cost in whch each unit of inventory is

specifically identified.

6. Lower-of-cost-or-market method F. A method of allocating merchandise cost that assumes that the first goods purchased

are the first ones sold, and the last goods purchased remain in inventory.

7. Periodic inventory system G. The inventory value of goods that were sold during the accounting period.

8. Perpetual inventory system H. A method of allocating merchandise cost that assumes that the latest goods purchased

are the first ones sold, and the oldest items purchased remain in inventory.

9. Specific identification method I. Under this system the ending inventory and cost of goods sold are determined at the end

of the accounting period when a physical inventory count is taken.

10. Weighted average method J. This accounting principle says that we should never anticipate gains, but always anticipate

and account for losses.

11. Cost of Goods Sold K. Net sales minus cost of goods sold.

Based on Exercise E11-4A, page 426

With the periodic inventory method, the Cost of Goods Sold and Gross Profit are calculated in the steps

explained on pages 407-408 of your text. Using those steps and this information presented for Fluter

Hardware please answer the questions below.

Sales……………………………………………………………….. $120,000

Sales Returns and Allowances ……………………………………. 900

Sales Discounts……………………………………………………. 650

Merchandise Inventory, January 1…………………………………. 35,000

Purchases during the period……………………………………….. 77,600

Purchases returns and allowances during the period………………. 4,100

Purchase discounts taken during the period………………………… 2,300

Freight-in on merchandise purchased during the period…………… 1,250

Merchandise Inventory, December 31……………………………… 32,000

1. What is the amount of net sales?…………………………

2. What is the amount of net purchases?………………….

3. What is the amount of goods available for sale?…..

4. What is the amount of cost of goods sold?……………

5. What is the amount of gross profit? ……………….

Sales……………………………………………………..

Less: Sales Returns and Allowances…………………….

Less: Sales Discounts……………………………………

1. Net Sales………………………………………………………

Cost of Goods Sold:

Merchandise Inventory, January 1………………………..

Purchases …………………………………

Less: Purchase Returns and Allowances….

Less: Purchase Discounts………………….

2. Net Purchases…………………………………

Add: Freight-in………………………………………….. &

AC 107 AC107 AC/107 ENTIRE COURSE HELP – ASHFORD UNIVERSITY

AC 107 Week 7 Discussion

Discussion Questions

- Inventory Ethics: Jason Tierro, an inventory clerk at Lexmar Company, is responsible for taking a physical count of the goods on hand at the end of the year. He has been performing this duty for several years. This year Jason was very busy due to a shortage of personnel at the company, so he decided to just estimate the amount of ending inventory instead of doing an accurate count. He reasoned that he could come very close to the true amount because of this past experience working with inventory. Besides, he was sure that the sophisticated computer program that Lexmar had just invested in kept an accurate count of inventory on hand.

- What is your opinion of Jason’s reasoning? Why?

- If Jason underestimates the dollar amount of ending inventory, what effect will it have on net income for the current accounting period?

- Since the perpetual inventory system maintains an up-to-date balance in the general ledger account for Merchandise Inventory, is a physical inventory count still necessary? Why?

- Unearned Revenue: When a customer pays in advance for a product or service such as a prepaid insurance policy, the business that sold the item will record the cash received as an asset and the future obligation to provide the item as a liability. Please give some thought to different business situations where the customers may pay in advance and provide an example here.

- Using your example, which account is debited to record the payment received? Which account is credited?

- When the business provides the product or service, which account is debited? Which account is credited?

- What do we mean by the term “deferred revenue”?

- How would these transactions be recorded under the cash basis of accounting? What are the benefits of recording the deferral under the accrual basis?

AC 107 AC107 AC/107 ENTIRE COURSE HELP – ASHFORD UNIVERSITY

AC 107 Week 7 Unit 7 Key Assessment CLO 3

Throughout this course, we have been using the accrual basis of accounting to complete our work. However, there are two other methods of accounting, the cash, and the modified cash bases.

For this assignment please answer each of the following questions in a short paragraph:

- Explain the accrual, cash, and modified cash bases of accounting.

- Compare the methods and demonstrate the similarities, differences, advantages, and disadvantages of each method.

- Which method seems easiest to work with? Keep in mind not only the ease of recording the transactions but the ease with which the accountant can use the resulting financial information.

- Which method(s) are approved by GAAP?

Please complete the essay on a Word document and upload it here just as you do with your other assignments. It may be completed in a listing format rather than APA style. Don’t forget to use complete sentences and correct spelling and grammar. Explanations must be in your own words.

AC 107 AC107 AC/107 ENTIRE COURSE HELP – ASHFORD UNIVERSITY

AC 107 Final Exam Guide (100% Score)

Question 1

On any given day, it is unlikely that the balance in the Cash account in the depositor’s general ledger will be the same as the bank balance.

Question 2

In the journal entry to record the daily cash receipts for sales, a cash shortage in a change fund is entered as a debit to Cash Short and Over for the amount of the shortage.

Question 3

To reconcile the bank statement, which of the following amounts would be added to the bank statement ending balance?

Question 4

The check written to establish the petty cash fund is recorded in the journal by entering a debit to Petty Cash and a credit to Cash for the amount of the check written.

Question 5

Part of the Sarbanes-Oxley Act (SOX) requires that management of publicly traded companies provide a statement that they understand their responsibility for maintaining adequate internal controls as well as a report on the effectiveness of the current controls.

6

The control activities of internal controls include the following:

Question 7

Management creates the control environment for a business by setting the ethical and professional norms.

Question 8

The Sales Returns and Allowance account is credited for the selling price of any merchandise returned by a customer.

Question 9

Sales Revenue less sales returns and allowances and less sales discounts equals net sales.

Question 10

The amount of sales tax collected is recorded in the Sales Tax Revenue account.

Question 11

A customer returns merchandise that was delivered in poor condition and that does not meet specifications. The account that the customer would credit for the amount of the return is

Question 12

Merchandise is sold on account for $90, and the sale is subject to sales tax of $5.40. The Sales Revenue account should be credited for

Question 13

A list showing the amount due from each customer as of a specified date is known as a

Question 14

Cash discounts off the invoice price of goods sold may be granted by the seller to encourage early payment of the invoice.

Question 15

When a business uses the perpetual inventory system the balance in the Inventory account is updated every time that merchandise is acquired or sold.

Question 16

For merchandising businesses using the periodic inventory system, the account “Purchases” is used only to record the cost of merchandise acquired for resale.

Question 17

The discount terms on an invoice are 3/15, n/30. This means that

Question 18

Postings to the accounts payable ledger and the accounts receivable ledger should be completed daily.

Question 19

Which of the following indicates that the buyer must pay the transportation costs for items purchased?

Question 20

An invoice of $300 dated April 2 is subject to credit terms of 2/10, n/30. If the invoice is paid on April 10, the amount to be paid would be

Question 21

When a business uses a subsidiary accounts receivable ledger, there is no need to keep a summary, controlling accounts receivable account in the general ledger.

Question 22

If a business sells its products first-in, first-out so that perishable items do not spoil, the accounting department is required to use the FIFO method of valuing ending inventory and cost of goods sold on the financial statements.

Question 23

Understating ending inventory causes the net income to also be understated.

Question 24

If the market value (replacement cost) of inventory is less than the inventory value reported in the ledger, the lower-of-cost-or-market rule requires that we record a loss as soon as we are aware of it.

Question 25

When merchandise is purchased on account and the PERPETUAL inventory system is used, the journal entry for the purchase would include:

Question 26

Under the PERIODIC inventory system, the merchandise inventory and the cost of goods sold for the current period are determined

Question 27

The following data applies to a particular item of merchandise. The first numeric column shows the quantity purchased and the second numeric column shows the purchase price of each unit.

On hand at the start of the period 300 $5.10

1st purchase 500 $5.20

2nd purchase 700 $5.30

3rd purchase 600 $5.50

Number of units available for sale 2,100

On hand at the end of the period – 500

Number of units sold during the period 1,600

Calculate the cost of goods sold using the FIFO method for the 1,600 units sold.

Question 28

he following data applies to a particular item of merchandise. The first numeric column shows the quantity purchased and the second numeric column shows the purchase price of each unit.

On hand at the start of the period 300 $5.10

1st purchase 500 $5.20

2nd purchase 700 $5.30

3rd purchase 600 $5.50

Number of units available for sale 2,100

On hand at the end of the period – 500

Number of units sold during the period 1,600

Calculate the cost of goods sold using the LIFO method for the 1,600 units sold.

Question 29

When a business uses the periodic inventory system, the first adjusting entry to Merchandise Inventory will close the beginning balance to zero with a credit. The second entry to Merchandise Inventory will add the balance counted during the physical count with a debit.

Question 30

Under the accrual basis of accounting, revenue is recorded when earned regardless of when cash is received.

Question 31

Unearned revenue is reported as a(n)

Question 32

Sports, Inc. plans to sell season football tickets for the 10 games played from September through November. The tickets sell for $45 per season package On April 30, the office reports that it has sold 200 season ticket packages. The correct entry to record the sale of the season tickets is

Question 33

The journal entry to record a cash shortage in the change drawer will include a credit to the account “Cash Over and Short”.

Question 34

The consistency principle states that, in general, accountants should use the same accounting methods from one period to the next.

Question 35

The cost of goods available for sale minus the cost of goods sold =

Question 36

The lower-of-cost-or-market rule is based on which accounting principle?

Question 37

The FIFO method of accounting for inventory and cost of goods sold assumes that the oldest items are the first ones sold and the newest goods are still in ending inventory.

Question 38

Unearned revenue is a liability account.

Question 39

A business using the perpetual inventory system reports $125,000 in the Inventory asset account at the end of the accounting period. A physical count of inventory shows that there is $130,000 actually on hand. The journal entry to adjust the accounting records will include a debit to Inventory Short and Over for $5,000.

Question 40

Which of the following statements about the expanded income statement for a business using the periodic inventory method is FALSE?

AC 107 AC107 AC/107 ENTIRE COURSE HELP – ASHFORD UNIVERSITY

AC 107 Week 1 Quiz (100% Score)

Question 1

Stockholders own which type of business?

Question 2

A business that purchases products from another business to sell to customers is called a

Question 3

An example of an expense is

Question 4

The financial statement that shows the amount of the company’s assets, liabilities, and owner’s equity on a specific date is called a(an)

Question 5

Increases in owner’s equity may come from

Question 6

The accounting equation may be expressed as

Question 7

Jason purchased office equipment for $4,800 on account. This transaction would

Question 8

GAAP are the procedures and guidelines to be followed in the accounting and reporting process.

Question 9

Since supplies last for several months, they are recorded as assets.

Question 10

According to the business entity concept, a proprietor may include nonbusiness assets and liabilities in the business entities accounting records.

AC 107 AC107 AC/107 ENTIRE COURSE HELP – ASHFORD UNIVERSITY

AC 107 Week 2 Quiz (100% Score)

Question 1

If John Smith, the owner of Smith Accounting Services, deposits $10,000 in cash as the original investment into his business, the journal entry to record this transaction includes a debit to cash for $10,000 and a credit to John Smith, Capital for $10,000.

2 out of 2 points

To debit an account means to enter an amount on the left side of the account in the t-account, the general journal, and the general ledger.

Question 3

2 out of 2 points

At least two accounts are afffected by every transaction.

Question 4

2 out of 2 points

The purpose of a journal is to provide a chronological record of all transactions completed by the business.

Question 5

2 out of 2 points

Your business pays the monthly rent in the amount of $1,000. The journal entry to record this transaction includes a debit to the Cash account for $1,000 and a credit of $1,000 to the Rent Expense account.

Question 6

2 out of 2 points

The second set of debit and credit columns in the general ledger is used to show the new balance in the account after an entry has been posted from the journal.

Question 7

2 out of 2 points

Assets and expense accounts have a NORMAL

Question 8

2 out of 2 points

The Owner, Drawing account should be used to show

Question 9

2 out of 2 points

The normal balance of the Owner’s Capital account

Question 10

2 out of 2 points

The Posting Reference column of the journal provides a cross-reference between the

AC 107 AC107 AC/107 ENTIRE COURSE HELP – ASHFORD UNIVERSITY

AC 107 Week 3 Quiz (100% Score)

Question 1

2 out of 2 points

Stockholders own which type of business?

Question 2

2 out of 2 points

A business that purchases products from another business to sell to customers is called a

Question 3

2 out of 2 points

An example of an expense is

Question 4

2 out of 2 points

The financial statement that shows the amount of the company’s assets, liabilities, and owner’s equity on a specific date is called a(an)

Question 5

2 out of 2 points

Increases in owner’s equity may come from

Question 6

2 out of 2 points

The accounting equation may be expressed as

Question 7

0 out of 2 points

Jason purchased office equipment for $4,800 on account. This transaction would

Question 8

2 out of 2 points

GAAP are the procedures and guidelines to be followed in the accounting and reporting process.

Question 9

2 out of 2 points

Since supplies last for several months, they are recorded as assets.

Question 10

2 out of 2 points

According to the business entity concept, a proprietor may include nonbusiness assets and liabilities in the business entities accounting records.

AC 107 AC107 AC/107 ENTIRE COURSE HELP – ASHFORD UNIVERSITY

AC 107 Week 4 Midterm Exam (100% Score)

Question 1

Generally accepted accounting principles (GAAP) are the procedures and guidelines to be followed in the process of preparing financial statements.

Question 2

The Financial Accounting Standards Board (FASB) is a non-governmental agency that creates the GAAP rules for accounting.

Question 3

Stockholders own which type of business?

Question 4

If the total of owner’s equity + liabilities increased during the period, then assets must also have increased.

Question 5

When the owner withdraws cash from the business it will result in an increase in owner’s equity.

Question 6

The balance sheet reports assets, liabilities and owner’s equity on a specific date.

Question 7

Stephen purchased office supplies for $800 in cash. This transaction would

Question 8

To debit an account is to enter an amount on the left column in the journal entry.

Question 9

Prepaid Insurance is an expense account.

Question 10

Mary’s business has performed services on account. The journal entry to record this transaction would include a debit to Cash and a credit to Service Revenue.

Question 11

The normal balance of the Owner, Capital account

Question 12

The normal balance of the Accounts Receivable account is

Question 13

The balance sheet

Question 14

The purpose of the general journal is to provide a chronological record of all transactions completed by the business.

Question 15

The purpose of the trial balance is to prove that the total of the debit balances and the total of the credit balances in the ledger accounts are equal.

Question 16

The journal provides the information needed to transfer debits and credits to the accounts in the general ledger.

Question 17

Jason’s business has purchased a new delivery van on account. The journal entry to record this transaction includes

Question 18

The journal entry to record payment for Delivery Equipment that was previously purchased on account would include

Question 19

If the owner of a company invests cash in the business, the journal entry would include

Question 20

Service Revenue performed for cash received immediately is recorded in the journal by

Question 21

If cash is paid for office rent, the journal entry includes

Question 22

Accounting for revenue using the cash basis of accounting means that no entry is made to the revenue account until the cash is received for the services performed.

Question 23

The book value of an asset is calculated by subtracting the accumulated depreciation from the cost of the plant asset.

Question 24

If the total of expenses is greater than the total of revenue in the income statement, the business has a net loss.

Question 25

A contra-asset has a normal debit balance.

Question 26

Adjusting entries always affect both an income statement account and a balance sheet account.

Question 27

A business records revenue when earned and records expenses when they are incurred regardless of whether the cash has been received or paid. This business is using which basis of accounting?

Question 28

Supplies are reported at $500 on the trial balance, but only $350 are still on hand as found during a physical count. The adjusting journal entry would be:

Question 29

The Income Summary account appears on the income statement at the end of the accounting period.

Question 30

The statement of owner’s equity is a statement which summarizes all of the changes in the Owner, Capital account during the accounting period.

Question 31

Assets, liabilities, and Owner, Capital are permanent accounts.

Question 32

The total revenue for the month of June was $6,500.

The total expenses for the month were $3,500.

Withdrawals (Owner, Drawing) for the month were $600.

The net income for the month was

Question 33

The order in which the financial statements should be prepared is

Question 34

The journal entry to close the revenue accounts at the end of the accounting period includes

Question 35

The account to which the Owner, Drawing account is closed at the end of the accounting period is

Question 36

The business entity concepts requires that non-business assets and liabilities are not included in the business’ records.

Question 37

A compound journal entry is one that records the transaction in three or more accounts.

Question 38

The Generally Accepted Accounting Principle (GAAP) rule which says that we record assets at their original cost is called the

Question 39

As of the end of the accounting period the employees have earned $1,000, but payday is not until the next period. The adjusting entry prepared at the end of the accounting period to record this includes

Question 40

Under which basis of accounting are plant assets such as buildings and equipment recorded as assets when purchased and then depreciated as they are used?

AC 107 AC107 AC/107 ENTIRE COURSE HELP – ASHFORD UNIVERSITY

AC 107 Week 5 Quiz (100% Score)

Question 1

2 out of 2 points

If the terms of an invoice dated April 10 are 3/10, n/30, the invoice must be paid on or before April 20 in order to be entitled to a cash discount.

Question 2

2 out of 2 points

A cash discount is offered to encourage customers who purchase merchandise on account to pay early.

Question 3

2 out of 2 points

Gross sales minus sales returns and allowances and minus sales discounts equals net sales.

(Gross sales – sales returns and allowances – sales discounts = net sales.)

Question 4

2 out of 2 points

After all the Accounts Receivable entries from the journal are posted to the general ledger and the accounts receivable ledger, the ending balance in the general ledger account for Accounts Receivable will be equal to the total of the customers’ balances in the Schedule of Accounts Receivable.

Question 5

2 out of 2 points

Merchandise is sold on account for $90, and the sale is subject to sales tax of $5.40. The Sales Revenue account will be credited for

Question 6

2 out of 2 points

The summary Accounts Receivable account in the general ledger is called a(n)

Question 7

2 out of 2 points

FOB shipping point means that the seller will pay the transportation charges.

Selected Answer: False

Correct Answer: False

Response Feedback: Correct! With FOB shipping point the buyer pays the freight charges.

Question 8

2 out of 2 points

For a merchandising business, the account “Purchases” is used only to record the cost of merchandise acquired for resale.

Question 9

2 out of 2 points

Purchase Returns and Allowances is a contra-purchases account.

Question 10

2 out of 2 points

Which of the following indicates that the buyer will pay the transportation costs?

AC 107 AC107 AC/107 ENTIRE COURSE HELP – ASHFORD UNIVERSITY

AC 107 Week 6 Quiz (100% Score)

Question 1

2 out of 2 points

In a business that sells its products first-in, first-out so that they don’t spoil, the accounting department must also use the first-in, first-out method for valuing ending Inventory and Cost of Goods Sold.

Question 2

2 out of 2 points

Understating the ending inventory causes the cost of goods sold to be overstated.

Question 3

2 out of 2 points

Under the perpetual inventory system the Merchandise Inventory account is debited for the cost of merchandise purchased.

Question 4

2 out of 2 points

The principle of conservatism states that gains should not be anticipated by recording them in the accounting records before they actually occur, but that probable losses should be recognized and recorded.

Question 5

2 out of 2 points

When prices are rising, the FIFO method produces the lowest net income.

Question 6

2 out of 2 points

The lower-of-cost-or-market rule says that if the replacement cost of inventory is less than the original purchase cost of that inventory, the business should record the difference as a loss as soon as it is aware of it.

Question 7

2 out of 2 points

Under the periodic inventory system, the merchandise inventory and the cost of goods sold for current period are determined

Question 8

2 out of 2 points

Cost of Goods Sold may include all of the following EXCEPT

Question 9

2 out of 2 points

The inventory valuation system that assigns the most recent purchase costs to the ending inventory shown on the balance sheet is

Question 10

2 out of 2 points

The accounting principle which says that a business must continue to use the same accounting methods unless there is strong justification for a change is called